2021 was a difficult year for buyers; especially those looking for a first home. We have seen prices rise in almost every segment of real estate, from resale homes to condominiums to land.

However, the end of the second quarter of 2021 could give shoppers a glimmer of hope – while prices are still a long way from low, the spike has been at least not as dramatic as it was in the past four quarters. This is what is happening right now:

Prices rose again in the second quarter of 2021, but much more slowly than in the previous quarters

According to URA flash estimates, the residential property price index is 163.7 points in the second quarter of 2021, an increase of 1.5 points in the last quarter. This is a 0.9 percent increase, a significant slowdown from Q4 through 2020 to Q1 2021 (during that time we saw a 3.3 percent jump).

OCR properties led the increase in condominiums, up 1.8 percent, above the 1.1 percent increase in the first quarter.

CCR condominium prices rose only slightly, by 0.6 percent, largely in line with the last quarter. RCR condominiums were responsible for most of the decline, with prices rising only 0.3 percent (RCR condos rose 6.1 percent in the previous quarter).

New condominium prices now average $ 1,922 per person across the island, according to Square Foot Research.

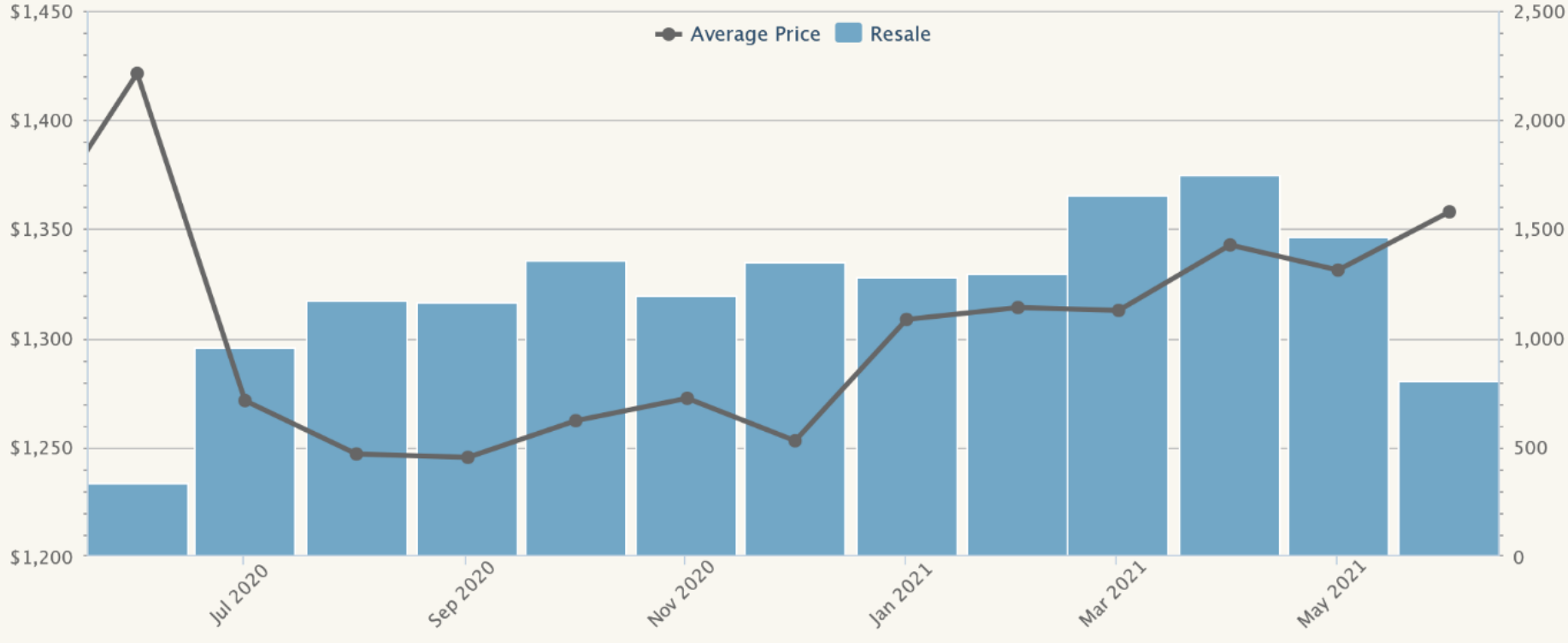

In the condominium resale market, average prices across the island are $ 1,358.

Note that the decline in sales price and volumes specifically for the month of June is due to a return to phase two Covid measures. During this time, restricted visibility and closings of show flats caused a severe temporary slump.

However, we note that prices are still up 7.3 percent year over year and the second quarter of 2021 marks the fifth straight quarter of rising prices. As the momentum slows, home prices are still rising steadily.

What Are Some Benefits For Home Buyers In The Second Quarter?

- Signs that new cooling measures may not be implemented after all

- Falling prices in the heavily demanded Holland V area

- Cheaper, upcoming OCR launches

- Home loan rates are likely to stay low through 2023

- Further GLS locations planned for 2H 2021

1. Indications that new cooling measures may not be carried out after all

With prices rising for five consecutive quarters, there were strong expectations that MAS would announce new cooling measures. So it was a surprise when MAS made it clear on July 1st: “We don’t think the market is currently overheated”.

It was clear to them that new cooling measures are not off the shelf if the situation changes (but new cooling measures are never completely off the shelf anyway).

Brokers told us this is both good and bad news for buyers:

“Those looking to close soon won’t want sudden restrictions on credit limits, increased ABSD, etc .; so there is some rest. But at the same time we have some buyers who were actually hoping for cooling measures because there is a possible knee-jerk reaction where the developers will cut prices. “

However, brokers found that this is an overall plus for buyers. One reason for this is that the fear of new cooling measures can lead to a buying frenzy and short-term price increases.

In addition, higher stamp duties and credit restrictions could more than compensate for the discounts, even if new cooling measures take effect.

2. Falling prices in the heavily demanded Holland V area

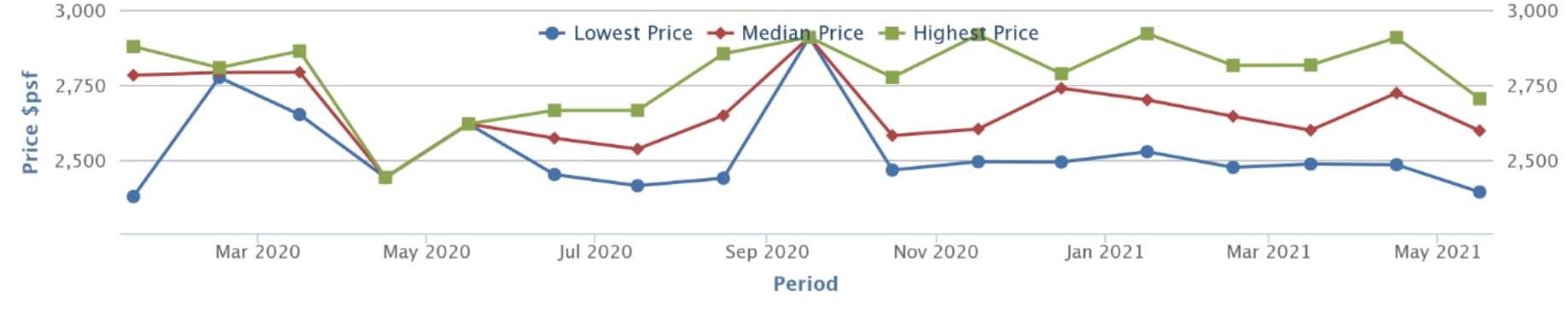

In our previous article we mentioned that there are seven new condominiums in the Holland V area. The prices have fallen sharply here. For example, Leedon Green, which we earmarked for one of the better family condos today, has seen average prices drop from $ 2,782 psf to $ 2,597 psf today:

Another example is Hyll on Holland (right across the street) – where a significant price cut was enough to move more than 85 units in a weekend.

We expect similar price drops over the next few months as developers near ABSD dates and competition in Holland V remains as intense as ever.

While pure investors want to avoid the fight, this is an opportunity for real homeowners to purchase property in a prime location at lower than expected prices.

3. Cheaper, upcoming OCR launches

OCR has seen limited reintroduction in the last few months, and what’s there has been mostly dominated by Treasure at Tampines. Meanwhile, developments like The Atelier and the upcoming Canninghill Piers are out of reach for the average Singaporean.

In the short term, however, we are seeing a number of lower cost OCR projects. Parc Greenwich EC (next to Greenwich V Shopping Center in Yio Chu Kang) and Pasir Ris 8 are all on the horizon. Provence Residence (another EC near Canberra MRT) also recently launched in May.

This could help slow the rise in OCR prices this quarter; as well as offering a more varied mix for new home buyers.

4. Home loan interest rates are likely to remain low through 2023

Bank home loan interest rates have averaged 1.3 percent since 2020. This is because the Federal Reserve in the United States is maintaining a near-zero interest rate policy to encourage the recovery from Covid-19.

When interest rates fell we were warned that this was only temporary; and indeed the Fed has postponed its rate hike schedule. However, it is currently expected to hit a two percent target sometime in 2023 by gradually raising interest rates.

This is generally a relief for home buyers as the rate hike is still a long way off (and likely to fall below the CPF and HDB loan rates of 2.5 percent and 2.6 percent, respectively).

Homebuyers who switched to bank lending in 2008-09 have now benefited significantly as bank lending rates have been lower than HDB rates for over a decade. Note, however, that private bank mortgages averaged between three and four percent prior to the global financial crisis.

5. Further GLS locations planned for 2H 2021

For those with an eye on the resale market, you’ll be happy to know that the government is increasing the supply of land for the second half of 2021.

The offer will be increased by 24.6 percent, from an estimated 1,605 new apartments in the first half of 2021 to 2,000 new apartments in the second half of 2021. The confirmed GLS location list currently includes four residential locations, including one ground floor location:

| place | Gross land ratio | Site area | European summer time. Number of new apartments |

| Translucent street | 2.8 | 1.96 | 645 |

| Lentor Hills Road (Package A) | 3.0 | 1.71 | 595 |

| Walk on the dairy farm | 2.1 | 1.56 | 385 |

| Bukit Batok West Avenue 8 (Executive Condominium) | 3.0 | 1.25 | 375 |

The expected introduction dates are September of this year (October and December for the Dairy Farm and EC locations).

On the reserve list there are another six residential plots (these plots are only released if there is sufficient interest from the property developer, which is very likely in the given market).

The increased supply somewhat alleviates fears of another block fever in 2021. This was a threatening issue as most of the 2017 block properties have already been developed and sold. Coupled with lower GLS supply in 2020, it was expected that this would spark a rush for collective sales among land-hungry developers.

Such an event would drive up resale property prices and ultimately affect new product launches as well (because homeowners displaced by an en bloc sale are cash rich and may be looking for a new condo to replace).

Keep calm and don’t rush to buy just because prices are going up

As prices go up, MAS has made it clear that they are monitoring the situation; It’s unlikely to overheat to the point where if you can’t buy now, you’ll be priced out by the end of the year.

So be careful and compare correctly. If everything seems too expensive right now, you might want to wait for the series of cheaper OCR projects to come; or turn your attention to more distant resale properties (especially if you are looking for larger homes).

This article was first published in Stackedhomes.