Given the current trend towards larger housing, it is inevitable that some Singaporeans will think of 3Gen housing. After all, these larger apartments are designed for those who want to accommodate their parents; and that is a growing need in our aging society.

But with some other options, like 1980s (bigger) apartments or executive apartments, are 3Gen apartments still worth it? Please note the following:

3Gen apartments compared to other apartments

3Gen apartments, also known as multi-generation apartments, are designed for large families living together (e.g. couples who live with one or both parents). These apartments were first introduced in September 2013 with the introduction of BTO to help multigenerational households live under one roof.

The 115 m² apartments have four bedrooms and three bathrooms, two of which are en-suite, in order to offer their residents more privacy and comfort.

This means that 3Gen apartments are larger than 5 bedroom apartments, although it is often pointed out that the difference in size is not that great. A typical 5 bedroom unit is approximately 1,184 square feet while a typical 3Gen unit is approximately 1,238 square feet.

That is a difference of only around 54 square meters. The functional area takes up the majority of this: a 5-room apartment has three bedrooms and a bathroom in terms of the room layout, a 3Gen apartment has four bedrooms and three bathrooms.

There are also different restrictions on buying and reselling.

You must be able to buy under the public scheme to get a 3Gen apartment.

The family cores can consist of:

- Married couple with one or both parents

- Engaged / engaged couples with one or both parents

- Widow or widower with child and one or both parents

- Divorce with a child and one or both parents

Your parents must be registered as essential residents of the apartment. Remember, substantial squatters cannot have another property under their name.

Apart from the usual restrictions (see the public system linked above), the income limit for new 3Gen apartments works a little differently. For these units, the income cap is $ 21,000 per month instead of $ 14,000 per month. However, your parents’ income (if any) is also taken into account.

There is no income limit for resale apartments.

The biggest difference is the rental and resale restrictions

Your prospective buyers will have to meet similar restrictions in order to buy your 3Gen home. This means that, as above, they must be a multi-generational family; and this significantly limits your potential buyers.

ALSO READ: Here you will find the largest 5-room HDB apartment in all 26 settlements

In addition, you can only rent out individual rooms in a 3Gen apartment after your five-year minimum usage period (MOP) has expired. With other apartments, you can usually rent rooms (but not the entire apartment) before the MOP is ready, as long as it is 3 rooms or larger.

How can 3Gen apartments be compared in terms of price?

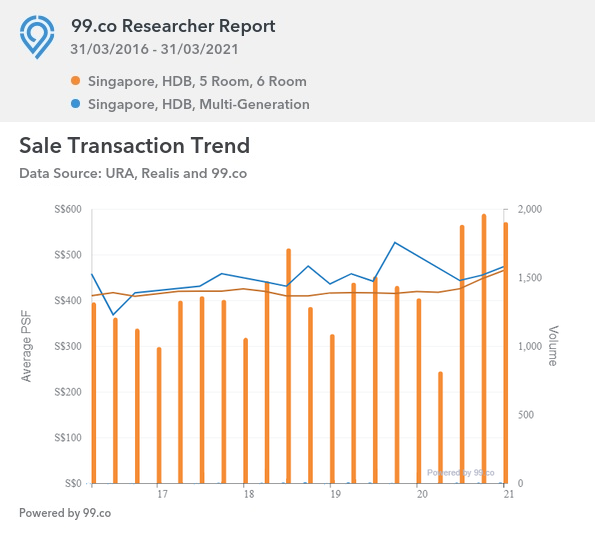

It’s hard to tell as 3Gen homes are pretty rare and the volume of transactions is low. there are often five or fewer transactions per quarter. So, take the following with caution:

We included a comparison with 5 bedroom apartments as these are their closest counterparts (they cannot be compared to executive apartments, maisonettes, etc. as they are much larger and older).

As of the first quarter of 2021, the average 3Gen flat across the island averaged $ 473 per person. The average for 5 bedroom apartments was $ 465.

That said, resale prices for 5-bedroom apartments are up around 13.4 percent from $ 410 in 2016. Prices for the resale 3Gs haven’t changed much during that time, rising from $ 458 -Dollars up about 3.4 percent.

Given the above, when is it worth getting a 3Gen apartment?

- You can cope with the price difference compared to a 5-room apartment

- Double key units are not in the budget

- Profits are not your main problem

- Functional space can trump living space

- You can handle the financial implications if you cannot live together

1. You can cope with the price difference compared to a 5-room apartment

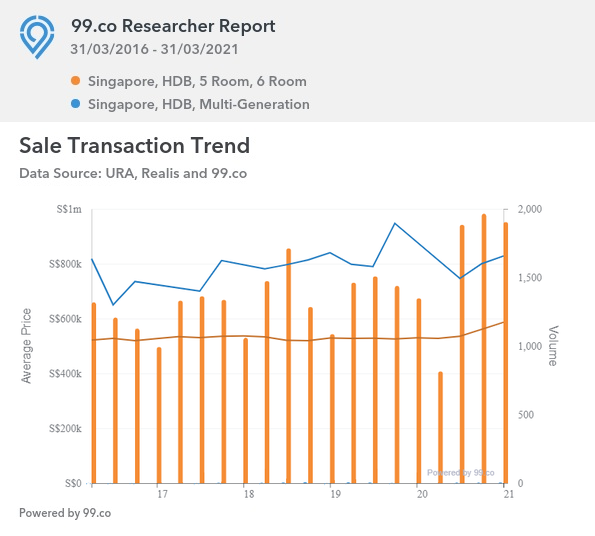

Note that the price difference between a 5 bedroom apartment and a 3Gen apartment can be significant when reselling:

Data from 99.co suggests the average amount of an island-wide 3Gen home was $ 828,000 in the first quarter of 2021, compared to an average of $ 586,474 for 5-bedroom homes *. This is a significant cost saving with the added benefit of making a 5 bedroom apartment easier to sell should it ever be necessary.

This is not a problem for BTO apartments. In fact, new 3Gen homes and 5-bedroom homes are very close together in terms of quantity, with both often in the $ 400,000 range (depending on the property). But 3Gen flats are pretty rare, and many BTO launches don’t include one.

* Again with the proviso that the transaction volume is low

2. Double key devices are not in the budget

Dual-key units are designed almost specifically for large families. These private condominiums are divided into two sub-units and offer a greatly improved level of privacy.

Many of the disadvantages of dual-key units will be found in 3Gen units anyway, such as: B. the exchange of living space for functional space or a smaller pool of potential buyers. But at least with dual-key units, you have improved privacy and no HDB-like restrictions (like ethnic quotas and the MOP).

Those who have the means to go private and purchase a double key unit should be concerned about this.

3. Profits are not your main problem

3Gen apartments are more difficult to sell because the only potential buyers are other multigenerational families. This also explains their low transaction volume, as described above.

That’s not to say that your 3Gen apartment will never sell for a good profit; just that it can take longer to go to market and buyers can keep you down because they know about the restrictions.

This may not seem like a big deal, however, as 3Gen homes are typically bought by pure homeowners rather than investors. If you are thinking of wealth development or returns, you should really look for 5 bedroom apartments instead.

4. Functional space can trump living space

3Gen apartments are larger, but may have less living space. By that we mean the extra 54 sq. ft. are largely occupied by the additional bedroom and attached bathroom.

This can also make some other areas of the house – like the living room or another bedroom – actually smaller compared to a normal 5-bedroom apartment. This varies by project, but it is important that you carefully consult the layout (for BTO units).

Whether this is acceptable depends on your needs. Families who need the extra bathroom can’t be bothered; but those who want a larger living room, dining room, or a more customized room layout will find that a 5 bedroom apartment will better suit their needs.

5. You can face the financial implications of not being able to live together

For example, let’s say you and your parents pool your funds to buy a $ 800,000 3-Gen apartment. What if you later discover that you can’t live under one roof?

You may find yourself in a situation where neither party has the financial resources to get your own apartment after the apartment is bought. And here, too, a 3Gen apartment is not easy to resell. This can lead to a painful domestic situation.

So we suggest that before everyone pool their money and buy a home together, everyone explores their alternatives in case something goes wrong. Only take the plunge if you have some kind of backup plan or safety net in place.

Ultimately, 3Gen apartments are only worth buying for real home ownership reasons

Double-income families and children (ie both parents are employed) tend to benefit most from 3Gen housing. This is because the grandparents can be in the same house to look after the children. Busy children also visit their parents less often, so a 3G apartment could encourage better family relationships.

ALSO READ: Your Ultimate Guide to 3Gen Homes in Singapore

However, a 3Gen apartment will never be high on the list when it comes to asset development choices; especially not with the high number of resale units paired with the limited pool of future buyers.

This article was first published in Stackedhomes.