You may have heard of the famous saying on the stock market that goes:

With May coming up, are you wondering whether you should really sell and take a break from the stock market in May?

We got you covered, buddy!

What is Sell in May and Go Away?

The famous saying goes that we should sell stocks when the warm weather starts in May and only invest again when the cold weather starts in November (the “summer months”).

Investors believe that the lack of market participants (likely due to vacation breaks) at the onset of warm weather can lead to a weak market period.

On the contrary, the months between Halloween and May 1st (the “winter months”) lead to better stock market results.

The graph below shows that the “sell in May and leave” strategy seems to be working. The May to October period lagged behind the November to April period for the S&P 500 index, which tracks around 500 of the top US companies in leading industries.

More recently, the index rose 28 percent from late October 2020 to late April 2021.

And it seems ripe for the market to take a breather for the next six months, which will entice you to sell your stocks so you can buy back later at a lower price.

However, timing the market is never easy.

Dancing in and out is catastrophic

If investors had sold out last May, they would surely bring themselves to their knees.

[[nid:527639]]]

The S&P 500 index increased by around 16 percent from May to October 2020.

We would never know what the coming month will look like, and neither would any future May.

Research studies have shown time and time again that a market absence and lack of the best market days can significantly reduce returns in the long run.

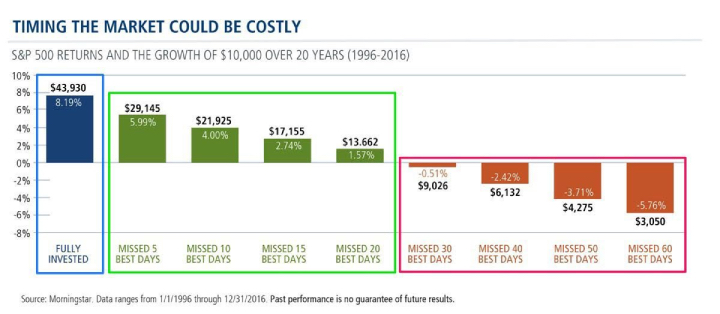

For example, according to Morningstar, if an investor had been fully invested from 1996 to 2016, $ 10,000 would have grown to a cool $ 44,000. This is around eight percent on an annual basis.

However, the lack of just five of the best days (out of the 20 years) would have cut the annualized return to six percent, or a huge difference of $ 14,785.

If the investor had missed the 10 best days, the average return would have halved to about $ 22,000.

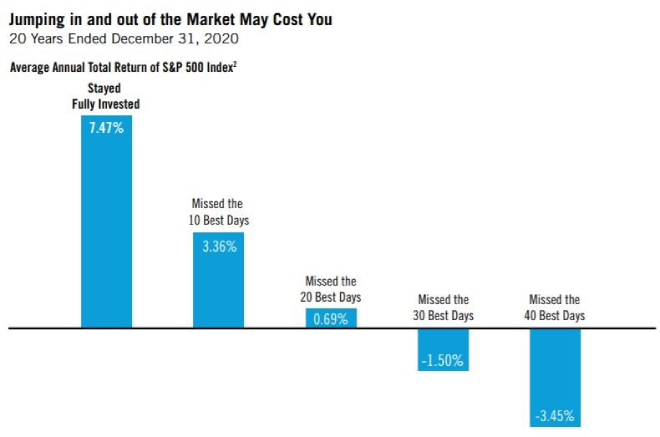

Another study, which ran from 2000 to 2020 and included the market crash caused by Covid-19, showed similar results.

Focus on the business

Instead of timing the market and depositing stocks when May comes, let’s ignore the old Wall Street adage and focus on the things that matter.

[[nid:526070]]]

That is, the business behind a company’s share price.

The idea is to invest in fundamentally strong companies at reasonable valuations and hold them for long periods of time regardless of what the market is doing.

The stock market can fall from time to time, including during the “sell and go away in May” period. But that’s exactly how the market behaves – it’s inherently volatile.

Indeed, if the stock market corrects itself in May and the following months, this could actually be a great buying opportunity to position our portfolio for the long term – just like in March 2020.

This article was first published in Seedly.