Singapore has one of the world’s highest GDP per capita (in PPP). Even so, Singaporeans tend to donate less than those in other rich countries. However, donating money to charity is a great way to spend some of the extra money you’ve made over the year.

This is because donations can not only help those around you, but can also give them “money back” through government and credit card incentives. Below are three reasons why donating money can improve your finances.

1. You can get a tax refund

One reason donating money can be good for your wallet is that you can get up to 250 percent tax deduction through December 31, 2023. For example, if you’re an animal lover, you might want to donate to the Animal Lovers League, which runs a no-kill animal shelter that is home to over 5,000 dogs and cats.

For example, if you choose to donate an average of $ 300 to $ 661 during the winter vacation season, you will get a deduction of $ 825 to $ 1,652.50 on your tax return on your tax return for the next year.

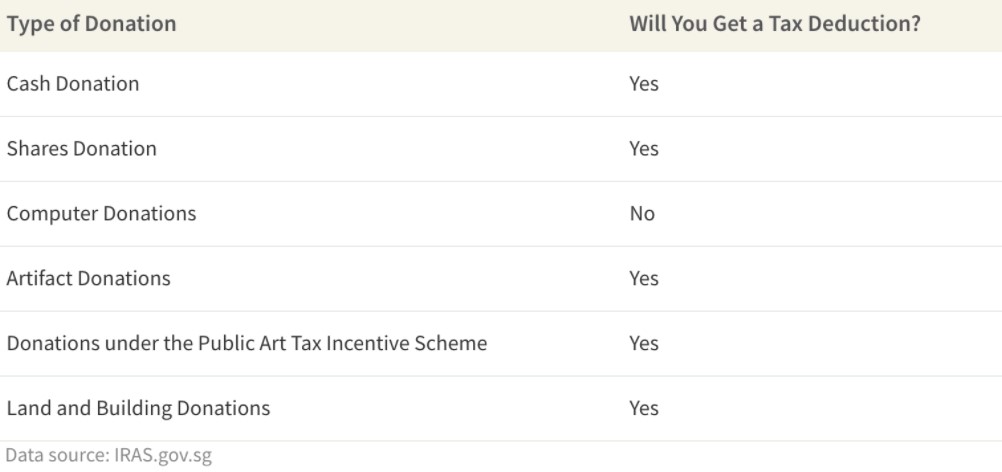

Tax deduction status by type of donation

To ensure you get the tax deduction, make sure your charity has approved IPC status on the government charity portal.

If it doesn’t, you may not get the returns on your year-end statement. Additionally, it’s important to know that if you receive a benefit from the donation, such as a gift box or item of clothing, you won’t get the full 250 percent.

Instead, you will receive the difference between the donation and the value of the service. So be sure to check the nature of your donation on the IRAS website to understand what does and does not qualify for a discount.

2. You can get money back on your credit card

A second reason to donate money is so that you can actually get money back on your credit card, depending on whether or not you have an award credit card.

For example, if you get three to five percent cashback or miles on your general purchases, an online donation to a charity can actually put money back in your pocket.

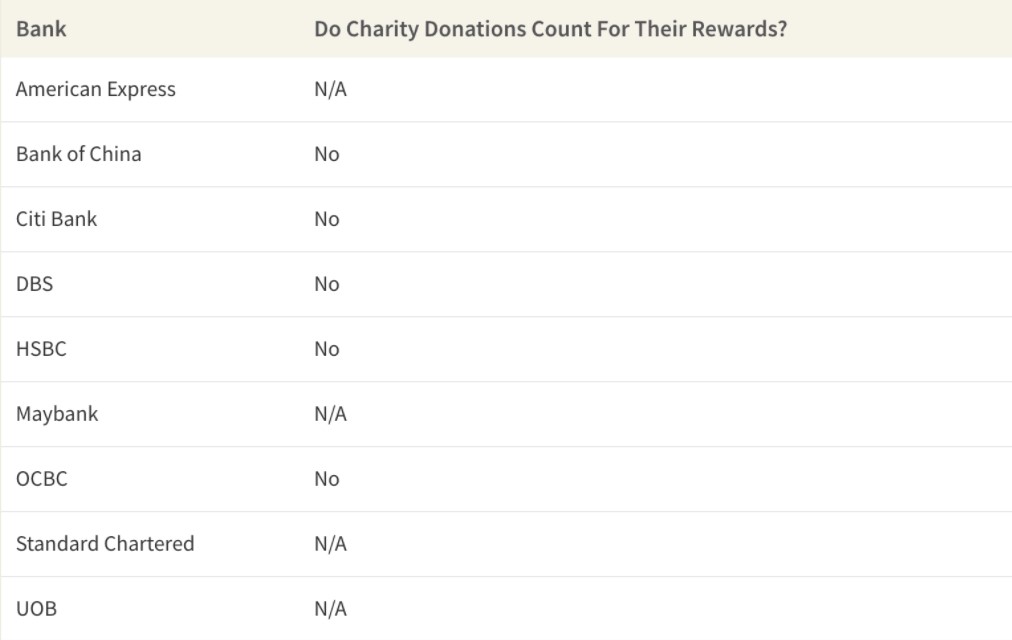

Popular Singapore Credit Cards and Reward Exclusions

It is important to note that most Singapore credit cards donations do not qualify for their cashback or other rewards program.

For example, Bank of China, CitiBank, HSBC, and OCBC donations do not qualify for discounts. On the flip side, banks like Standard Chartered and UOB don’t state whether or not charitable donations to nonprofit organizations are eligible for rewards programs.

In these cases, it is best to check with your bank before making any substantial donations.

3. It could help your career

After all, making a charitable donation could help your career advance. This is because spending your money on causes that are really close to your heart can lead to a great sense of achievement.

Studies have also shown that time and money can lower blood pressure, increase self-esteem, reduce stress, and lead to greater happiness.

In the workplace, this means you are more likely to be relaxed and focused as your confidence in your role as a benefactor increases your productivity and your self-esteem in the office.

Additionally, choosing a charity to donate to could put many of the problems that arise in your daily life into perspective. This means that you may have more understanding of employees’ interpersonal issues and try to make your workplace a success, thereby becoming a more productive, team-oriented person.

Charitable giving can help both you and your community

Whether you want to support child education, animal education, or cancer awareness, making a charitable donation is a wonderful way to support important causes in your community. In addition, it can bring you some additional benefits.

This is because at the end of the fiscal year you can get tax deductions, earn rewards on your credit card, and be more productive at work.

Before you donate to charity, however, make sure you are donating to an IPC registered charity and your credit card qualifies your purchase for their rewards program. Your philanthropic efforts will help both your community and you.

This article was first published in ValueChampion.