Let’s be honest

Many of us have been taught from a young age to always pay in full for everything we buy.

Because 1) failing to pay can mean theft and 2) no one ever wants to be sent to jail.

For a long time, credit cards were the only way to legally pay when Siamese made a purchase. Thanks to some interesting innovations in fintech, it’s now a lot easier to buy something without paying (at least for now). more convenient and suuuuper legal.

Introduced this new “Buy Now, Pay Later” (BNPL) feature.

Har? What’s this? Can you eat

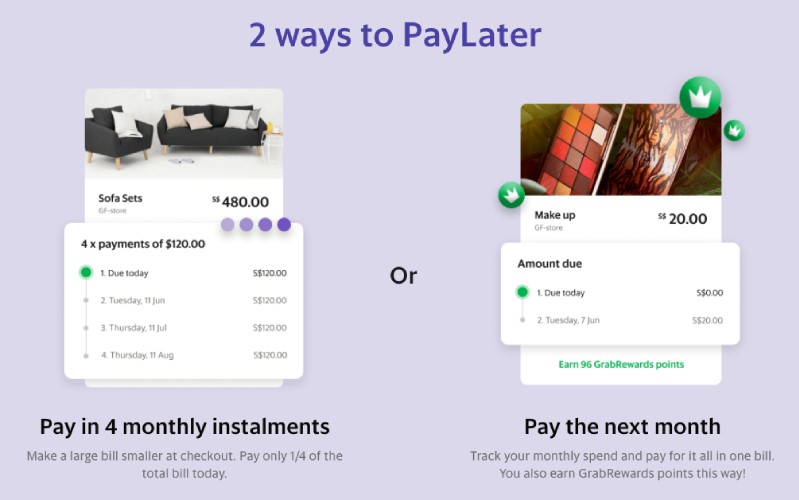

BNPL services are pretty self explanatory. These are services that allow users to make purchases over a period of time and pay for them in installments.

Now you might be wondering: iPhones can also be paid for in installments. What’s so special?

What gives BNPL services an advantage is that even general everyday items can now be paid for in installments, with the added benefits of no interest fees.

The best part? You don’t even need a credit card to register. A debit card is all that is needed. Shiok.

But I already have credit cards, what’s the difference?

It turns out that there are differences! Here is a breakdown:

1. 0 percent rates

BNPL services typically offer 0 percent interest rates with no processing fees for all items (big ticket or small ticket) that can be purchased with these services.

[[nid:518698]]]

With certain BNPL services, you can also collect bonus points / cashback / miles for bonus credit cards with bonus purchases with 0 percent!

Credit cards are limited to working with certain major merchants to offer rates of 0 percent interest over a period of time, mainly on items with large tickets.

Credit cards are also subject to processing fees for installment plans of around 0 percent and tend to limit the gain of reward points / cashback / miles for reward credit cards in such plans.

2. Ease of use

The barrier to entry for BNPL services is much lower, especially if you don’t need a credit card.

Youngins can even use these services before they are eligible to own one!

Additionally, there are no minimum income or employment requirements when compared to credit cards – Swee Lah!

3. Late Payment Fees

Both BNPL services and credit cards charge late payment fees, but differ in implementation.

Depending on the service, BNPL services may charge late payment fees based on the value of the item or even as a one-time fee.

Credit cards are pretty straightforward when it comes to late payment fees – you’re late and paying a large amount, usually three digits.

Owe money, pay money.

4. Credit Limits

Credit limits are one thing when it comes to both BNPL services and credit cards.

BNPL services tend to be stricter, with some setting maximum transaction limits based on whether a credit / debit card is linked to an account.

Compared to BNPL services, credit cards have much higher credit limits, some up to four times their monthly income. Choir sia.

ALSO READ: “Buy Now, Pay Later” Launches In Indonesia’s Online Malls

Wah so good confirm that you have spent too much.

And you are probably right! As the saying goes, too much good is probably bad for you.

[[nid:520148]]]

With all of these perks and benefits associated with using BNPL services, it’s much easier to fall into a trap and recklessly spend money buying items at the push of a button with no immediate consequences.

A survey conducted by the BNPL service Finder found that more than 27 percent of users suffered financially from a BNPL bug.

It is important to note that making purchases with BNPL services will damage your wallet just as much as paying in full. Instead, she only has slow bleeding.

Managing and budgeting your finances wisely is key to maximizing the value of such services.

Should I use BNPL services?

BNPL services are a great tool for people like you and me to shop with, provided we are responsible enough for our finances.

However, we find that people with irregular incomes can take advantage of BNPL services the most, such as freelancers.

BNPL services help such people make purchases with ease, especially during months when income is lower.

What to choose ah?

The BNPL industry is picking up speed and many companies are springing up to catch a piece of the pie. Rely, Atome, Hoolah and even Grab are just a few of the BNPL service providers available in the market. You should always revise the service to make a choice based on the plans they offer and how they meet your financial needs.

Like learning for O-Levels.

This article was first published in Wonderwall.sg.