2020 and 2021 are among the most unusual years in Singapore’s history. The combination of work-from-home arrangements and the effects of the circuit breaker has led many to find their own spot as soon as possible.

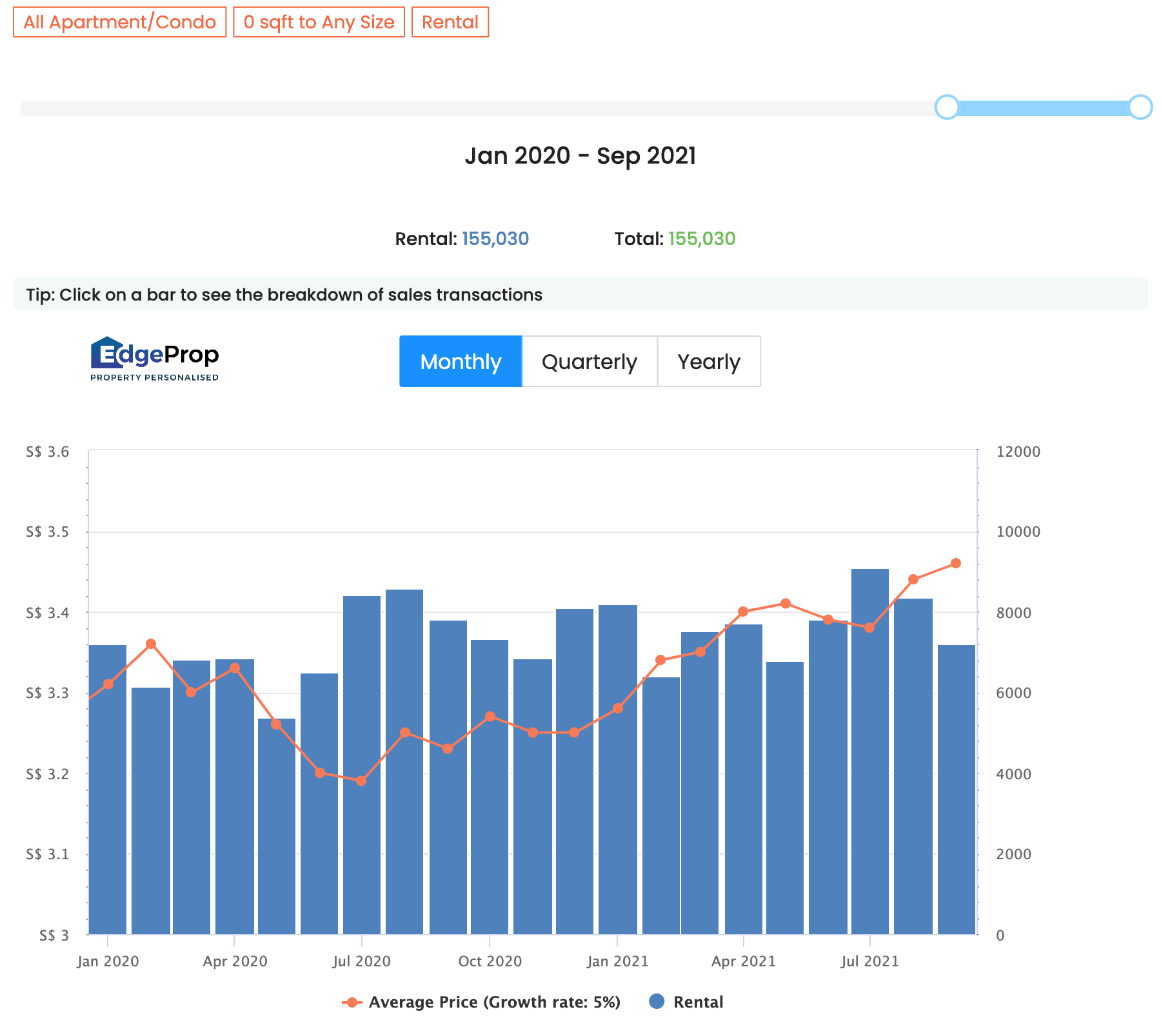

Some foreign workers also have difficulty returning home or returning when they do; these have led to longer leases and alternative agreements. Here you can see how the rental market has changed from 2021:

An apparent recovery from 1H 2020

Overall, the rental market seems to be doing better rather than worse under the pandemic.

Flash data from SRX, for example, shows rising condominium rents from the end of September 2021. The rents are now eight percent higher than at the same time last year. We’re still about 10 percent below the last rent peak (2013), but prices seem to be catching up.

HDB has also shown a strong performance on Covid-19. Since September rents have risen 15 months in a row, and HDB rents are 8.8 percent above the previous year. They are around seven percent below the 2013 high.

While condominium leasing volumes have declined compared to 2020, the decline is tiny; from 4,593 to 4,454 (September 2020 to September 2021).

On the other hand, the rental volume on the HDB rental market increased and reached 1,702 units in September of this year. This is an increase of 1,654 units at the same point in time in the previous year.

This is good news for most landlords; Events went contrary to predictions at the start of the pandemic, when it was believed that travel and economic problems would worsen the already weak rental market.

In fact, in the first half of 2020, as the pandemic took effect, we saw a dramatic drop in rental prices and volumes.

On the other hand, rising rental prices are currently an issue for many Singaporeans as well as foreigners. Based on conversations with brokers, tenants, and landlords, we’ve rounded up some rental issues in 2021 that you should be aware of:

- Work From Home is driving the demand for temporary accommodation

- The previous strategy of concluding shorter leases can backfire

- More locals are terminating work agreements abroad

- More and more expatriates want to avoid traveling to and from home

- Rising real estate prices and the home school distance (HSD) have influenced rent

- Later on, construction and renovation delays can keep rental demand high

1. Work From Home drives the demand for temporary accommodation

Many companies have switched to permanent Work From Home (WFH) agreements in view of the pandemic. For some, WFH will continue after Covid-19 and will become their standard work regime.

In addition, some brokers have mentioned that they have met tenants who have lost their previous jobs and have now turned to the digital economy; many of them have joined teleworking.

A broker said:

“I notice that there have been a lot more requests for HDB rental offers, about two or three months after the Circuit Breaker last year, and so far the volume of requests has not decreased.

Many people find that working from home is not very conducive to having parents and siblings around and the younger ones having classes online, parents also trying to work from home with Zoom calls, and so on.

However, many of them are too young to buy their own apartment or do not yet have the financial means to buy their own apartment. So many of them dared to move out and rent their own house. “

This has led to increased demand, even small units that are usually difficult to rent out.

“Usually single rooms are quite difficult to rent in non-central areas, but these lots are on a budget and they’re just happy to find their own space. If there is a pool or similar facilities, they like it even more because they can’t get it home. “

Therefore, tenants can find a surprising amount of competition; even for one-bedder in OCR and further from MRI stations.

2. The previous strategy of concluding shorter rental contracts can backfire

We asked why condominium rental volumes seem to be falling, and whether that suggests rental rates will follow.

However, many figures say this is not always the case; In fact, a decline in rental volume may indicate that tenants are trying to lock the rates before they continue to rise. One broker explained that:

“If a soft rental market is expected, as was the case in early 2020, it is common for the leasing volume to actually increase. Because the tenants expect falling rental prices – so they conclude shorter rental contracts in the expectation that they can quickly move to a cheaper location nearby or, with a bit of luck, even to the same settlement when prices fall. “

However, this strategy can backfire in a rental market with steadily rising prices. In such a situation, the landlord can charge a higher price when the time comes to renew the lease.

Therefore, the decline in rental volume can only be caused by tenants who previously signed three or six month leases and now opt for a longer term in order to “lock in” the prices.

Brokers have also expressed the opinion that trying to get discounts on shorter leases is generally a risky move. It is better to focus on finding an affordable and comfortable place, rather than gamble on potentially cheaper rents later.

After the lease expires, you might not find any alternatives nearby and be forced to move to an inconvenient or even more expensive location.

3. More and more locals are terminating work agreements abroad

Brokers pointed out that more Singaporeans are coming home due to the pandemic.

This includes locals who may not have expected to come home so abruptly and who do not have to buy a property on site yet. Many are also unsure about their future precautions – if they fly back after the pandemic, for example, they may not want to be saddled with a local property.

This leads to a rare situation where locals team up with foreigners to compete for good rental units.

A broker found that:

“Even if you decide to move permanently, it still takes time to buy. Renovation takes longer due to Covid, longer search for an apartment due to viewing restrictions. And of course when they buy new they have to wait for construction. So you are definitely stuck and have to look for a rental unit in the meantime. “

4. More and more expatriates want to avoid traveling to and from home

An example of this was the Movement Control Order (MCO), which left many Malaysian workers stuck on our side of the dam. Forced to find accommodation quickly, many of them were denied time to explore better places or get more reasonable prices.

However, it was not just Malaysian workers who were affected. Realtors have heard from many expats concerns about the difficulty returning home when they return home. Mandatory home stays (from both sides of the border) may concern them; as well as increased costs (e.g. paying for test kits) each time you move between countries.

As a result, more expatriates are content with longer rental contracts and dig in until the pandemic is over.

Brokers noted that this may be why leasing volumes appear to be falling; and that we may see this continue into the pandemic.

5. Rising real estate prices and the home school distance (HSD) have influenced the rent

Home School Distance (HSD) of one kilometer gives priority to a child when they start school (you can read more about it in this earlier article). This also applies to rental – so you can actually get priority by renting a unit near a school you want.

According to some brokers, the desire to be close to top schools – coupled with high private property prices – is driving some families to rent. A broker points out:

“Aside from the initial cost, some families may not want to stay in one area after the child has finished school. For example, if your child goes to high school for four years, you need to consider whether you want to live in the area after that.

Some also believe that high prices are due to a “covid wave” stemming from effects such as low interest rates; and they believe it makes more sense to buy a few years later when prices are lower.

So for the time being they rent near their child’s school and later buy at a desired location. Hopefully at lower prices. “

Realtors also noted that HSD has recently been redesigned with more properties (on average) within the 1km mark, this could better spread demand across the available rental units.

6. Later on, construction and renovation delays can keep rental demand high

When we asked if rental rates were likely to go down, the consensus was “not in the short to medium term”. This is currently due to a combination of factors. Some, like higher house prices and increased demand, were mentioned above.

However, we should also consider the staff shortages and disrupted supply chains that come with Covid-19. HDB has already experienced delays in housing construction and the private real estate sector is facing the same problems. There are a number of people who have sold their homes to take advantage of the strong demand and record prices and have instead invested those profits in buying a new launch.

This leads to an unusually high number of locals looking for rental apartments in a market in which – until the pandemic – almost exclusively foreigners made up the demographic tenants.

Don’t forget that more HDB upgrades can mean more renters!

Depending on how well your real estate agent is timing your upgrade, you may need to rent for a while. This is especially true if you want to sell your apartment first and then buy your condominium.

With over 50,000 homes reaching MOP and HDB upgrades being the main buyers, there are quite a number of Singaporeans who will end up in need of an interim home.

Talk to us if you want to upgrade, but do not want to pay the rising rent either. We have experts who might just find a way (but no promises!). In the meantime, you can follow us on Stacked for possible changes in the situation and view reviews of new and resale properties.

This article was first published in Stackedhomes.