As recently as 2017, OrangeTee and Edmund Tie & Company announced a new joint venture called Orange Tee and Tie (OTT) to form the third largest real estate agency in Singapore with more than 4,400 brokers.

How things have changed though.

With a recent major exodus from Orange Tee and Tie (OTT) towards other real estate agencies, there is a real possibility that the “Big Four” will soon become the “Big Three”. Singapore’s real estate firms now resemble an oligopoly in which only three “power players” may dominate the market. But is that a healthy situation for homebuyers?

The Singapore State Broker Today

When looking to buy or sell a home, you’ll find that there seem to be only four agency names: Propnex, ERA, OrangeTee & Tie (OTT), and Huttons.

These are the numbers reported by The Business Times:

It is estimated that the “Big Four” make up at least 80 percent of the active brokers in the market.

In 2021, agencies have become increasingly aggressive in their recruiting tactics; and are quite eager to lure agents away from each other. For example, in May of this year Propnex launched a “Rescue & Grow” package that subsidizes up to $ 3,000 in fines for an agent who switches to Propnex. ERA followed suit in June with a similar offer.

(Most real estate firms have a clawback clause that requires agents to pay back training fees or marketing expenses in the event they switch to another agency).

While not widespread, there was also a major exodus from OTT a few months ago; individual agents as well as some large groups moved to other agencies such as Huttons and Propnex.

If you see your former agent with a new name tag, it may be the reason.

Consolidating into just three major agencies may not be all too healthy

To explain how all of this matters, we need to look at real estate developers and their existing margins (see our previous article on this).

As we mentioned in the previous article, about five percent of the selling price is due to the developers’ sole commission payment (of course this is project dependent, but it’s a common thread that we see). You can’t really get around this because developers rely almost entirely on real estate companies to market their projects.

Since around the 90s, “the system” has worked like this: the developer only concentrates on setting up the project and perhaps providing the 3D images and other marketing materials. In addition, it is up to the agencies:

- Man the model apartments

- Set up websites about the project (if you google a development you will see hundreds of websites about the project, almost all agent owned. Some of them even call their websites the “official” developer site if not ).

- Pay real estate portals like PropertyGuru, 99.co etc to place listings

- Create ads that range from videos to social media content (sometimes with disastrous results, like this ad for an apartment in Midwood that caused outrage for its apparent snobbery).

- Engage and negotiate with the buyers

If you’re a homebuyer, think about the last time you spoke directly to a property developer. Chances are, the answer is never. All your requests are filtered through agents.

This has gotten to the point that in some cases buyers cannot even contact the developer to comment on shortcomings or dates of the first general meeting. In some of these cases, it is ultimately the real estate agent who needs to contact them.

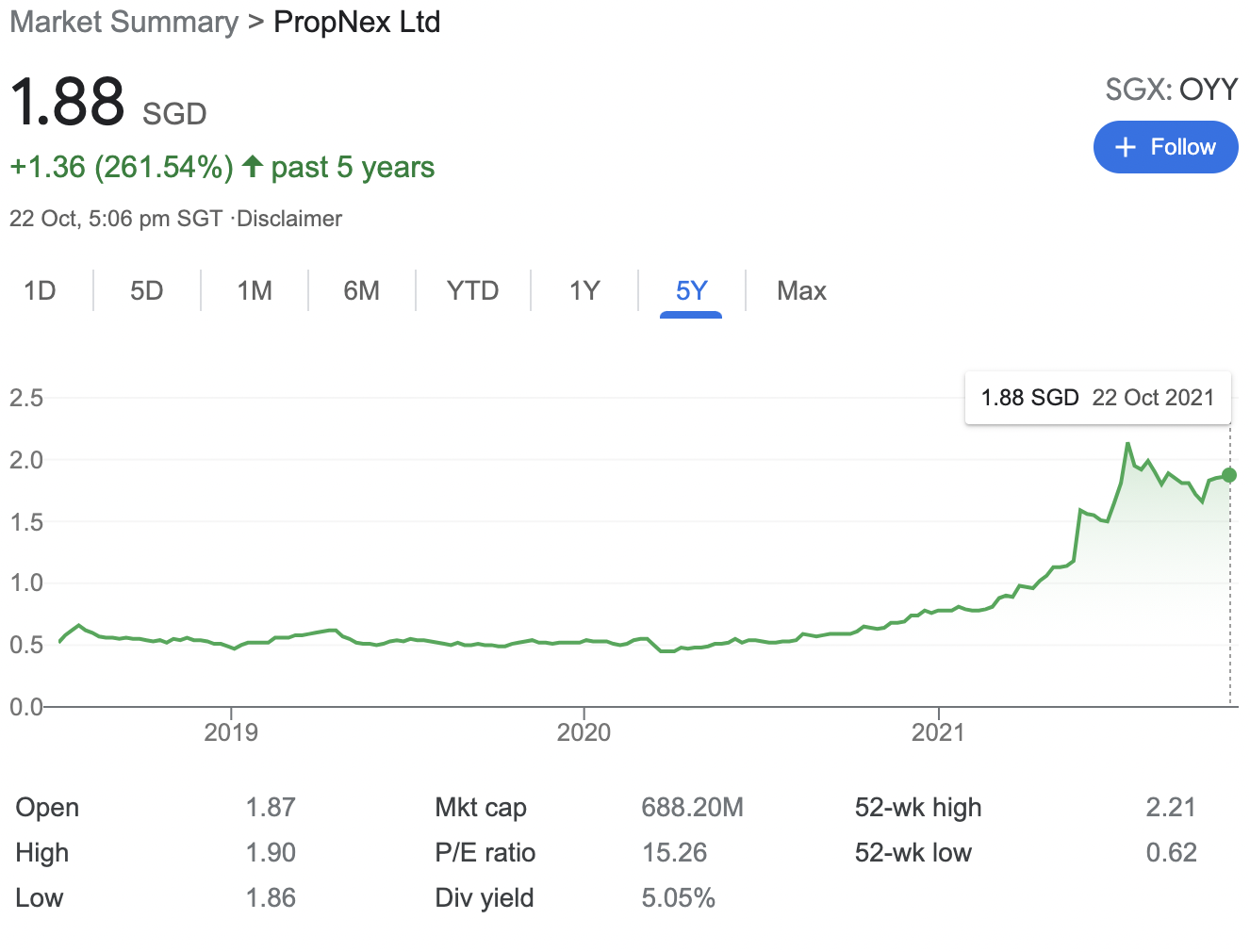

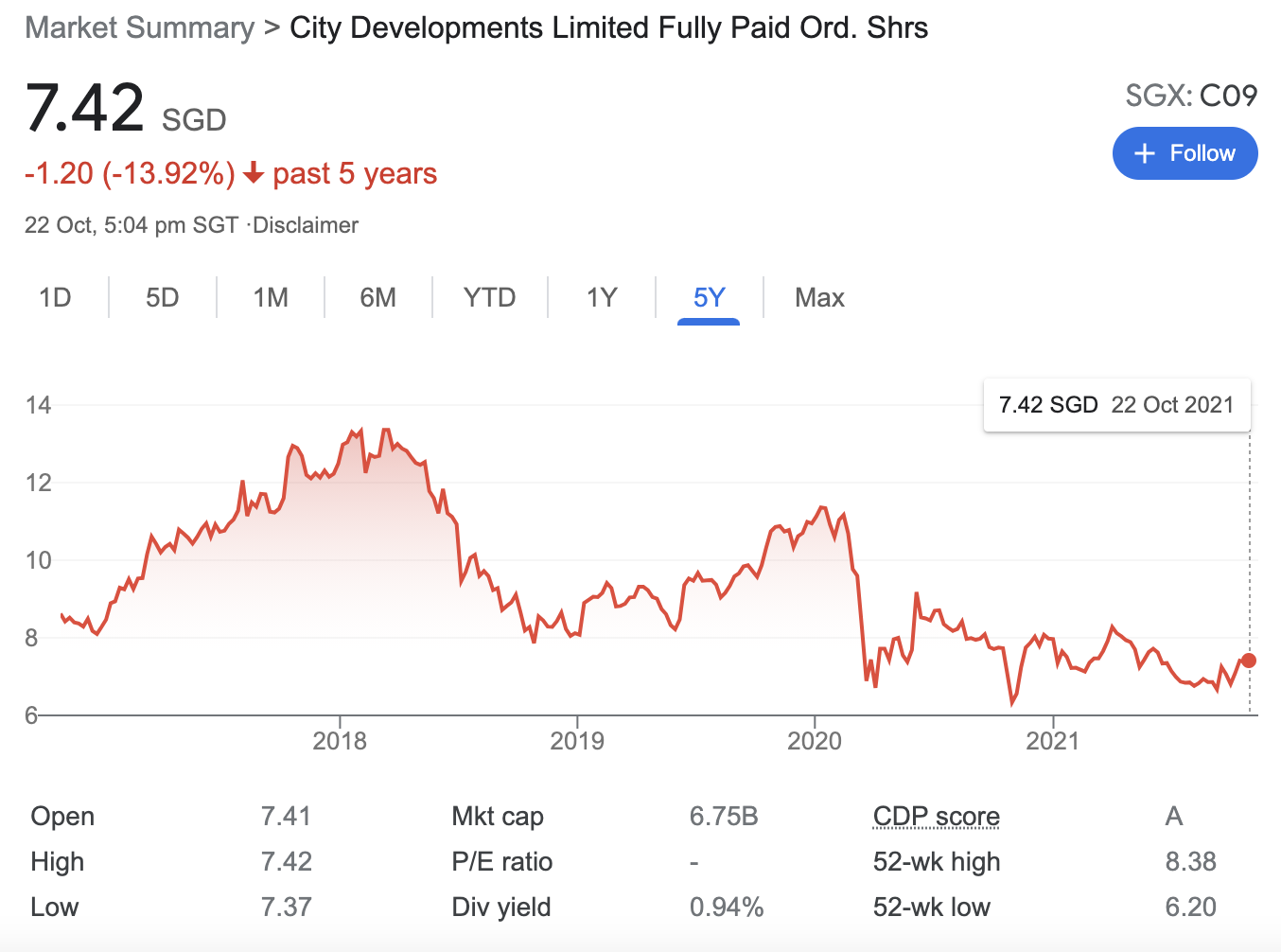

In fact, at the time of writing (mid-October 2021), stocks in real estate agencies like Propnex have been found to have an inverse relationship with developers. At the time of writing, Propnex is up 137.2 percent since the start of the year, while developers like CDL are down 7.3 percent and Frasers Property is down 6.5 percent.

Of course, stock prices move for a variety of reasons; but the correlation between the two is hard to ignore.

This over-reliance on real estate agencies is why developers struggle to negotiate commissions

At this point, developers desperately need real estate agents to market their units. They don’t have the database of potential buyers or the numerical reach required to advance their projects.

This is made much worse by the tight schedules developers work with – they have to complete and sell every unit of a project within five years so they don’t end up paying 30 percent of the property price as Additional Buyers Stamp Duty (ABSD).

The ability to move units in a timely manner requires a large number of agents, forcing developers to bow to the will of the largest agencies. Those unable or unwilling to pay higher commissions will attract fewer agents and run the multi-million dollar risk of missing the five-year deadline.

This leads to a one-sided situation in which agencies could charge ever higher commissions; and developers have very little leverage in the negotiations.

All of this has an indirect impact on home buyers

Some of the concerns here would be:

- You end up paying more just because of the commissions

- Displaced developers make compromises

- Price agreements are possible

- In the long run, it discourages improvements and innovations

1. Increased prices and the unhealthy trend of kickbacks

As we mentioned in our previous article, around five percent of the selling price can be paid out to these real estate agencies. In contrast, keep in mind that sellers in the resale market typically only pay a two percent commission.

When the big four (or the big three, depending on how fast things are going) all decide to increase their commissions, there isn’t all that much that developers can do. Since the developer margins are already quite tight, these could affect the final price of the property.

We’ve talked about this at length before, but the ripple effect here is the trend towards commission paybacks to the buyer. While it may seem like a win-win situation at first, it can often be more damaging than not.

2. Displaced developers make compromises

In our previous article, we mentioned that developers could see margins as high as 10 percent (in some cases they can be even lower). If the big agencies want to increase their commissions, developers could take the cost.

But what then happens to the quality of projects that are built with such tight budgets? We saw the impact of tight budgets in 2015 with the problems inherent in many Design, Build, and Sell Scheme Homes (DBSS).

Due to tight budgets, many DBSS apartments had problems in the first year, ranging from inappropriately narrow corridors to plumbing problems and leaks / stains.

So far, developers have rarely made compromises; But we don’t want to jeopardize the quality of our projects, we just want to serve the coffers of the real estate oligopoly.

3. There is a potential for price fixing

When you have many different agencies in the market, it becomes much more difficult to fix prices. Some might try to undercut the competition or offer developers a better deal. But when you only have the big four, it’s pretty easy for everyone to decide on a certain level of commission as the norm; or to reach an agreement on the joint collection of commissions.

Needless to say, this gets even easier when you shrink it down to the big three.

To be clear, we are not claiming that the big agencies have formed such antitrust or price-fixing agreements – simply that they are in a good position to do so if they want to.

Hopefully the authorities will step in when something like this happens. But it would be healthier if we removed the potential for such a scenario anyway.

4. In the long run, it discourages improvement and innovation

In recent years, the “Big Four” have focused on digital marketing. But we don’t think it was out of a need to compete with one another. It was probably out of a need to compete with real estate portals selling listings to brokers.

With a couple of huge agencies dominating the space, it’s hard for small agencies to get involved. This stifles innovation somewhat and there is less of a need to improve service quality.

This is now partially offset by internal competition – even within the same agency, each agent competes with the other. This sometimes translates into better service from some agents, more innovative approaches, and maybe even lower commissions (but we wouldn’t rely on that).

Nonetheless, it would be healthy if we had more agencies pushing all of their agents to compete tougher because of the quality of service and creative (but legal) approaches to transactions.

While we are not yet to see any serious negative effects from this oligopolistic situation, neither should we underestimate it. Hopefully the authorities create a more competitive environment by supporting small, emerging agencies trying to break into the real estate space.

This article was first published in Stackedhomes.