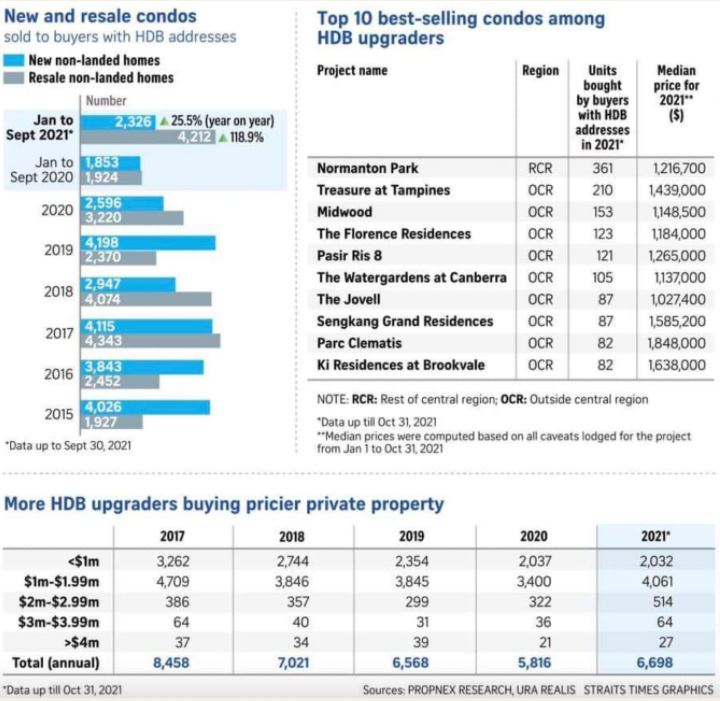

According to JLL, the number of HDB upgrades moving into condominiums is currently up over 21 percent year over year.

The idea of buying a condo in the midst of a pandemic seems worrying; and maybe it should, given the steadily rising prices we’ve seen over the past nine months. At current prices, it’s possible that some HDB upgrades go too far:

A brief explanation of the real estate market in 2021

For those new to the real estate market, the high prices can be hard to digest. Here is a quick snapshot:

From January to October prices rose on both the HDB and the condo market. The average condo costs around $ 1,705 across the island, while resale apartments cost an average of $ 500.

This means that condominium prices are around 20.7 percent above their last high in 2013; and remember that several rounds of cooling were initiated this year to bring the price back down.

The flat resale prices are also around 3.2 percent above the 2013 high and are also at their highest level for over eight years.

The real estate market may have started to adjust to measures like the Additional Buyer Stamp Duty (ABSD) and credit restrictions.

However, the measures to kill cash over valuation (COV), which were taken around 2013 for the resale flat-rate market, have clearly lost their effectiveness. While COV data is no longer released, both local agents – and news media – have seen a surge:

A third of resale homes purchased in 2021 were associated with COV, as opposed to a fifth in 2020. In contrast, COV was a growing norm from zero in late 2013 and was the norm from 2014 to mid-2019.

Do HDB upgrades start too much leverage despite higher flat-rate resale prices?

- Upgraders have a preference for large units

- Lots of FOMO purchases

- Low mortgage rates can create the appearance of affordability

- CPF was issued on down payments to meet TDSR

1. Upgraders prefer large units

It is sometimes pointed out that HDB upgrades tend to buy larger condos, with the average price closer to $ 1,300 to $ 1,400 psf. However, this doesn’t really mean a lot.

When it comes to affordability, the key issue is quantity, not price psf. Smaller units can cost up to $ 3,000 but have a total volume of $ 1.3 million or less; Conversely, a 2,000 square foot quadruple room would cost $ 2.8 million from just $ 1,400.

According to research by Cushman and Wakefield, the average size of units purchased has increased about 4.5 percent year over year. In the same linked report, Orange Tee & Tie reported

On-site brokers have advised that for many upgraders it doesn’t feel like an upgrade unless the new home is at least the same size as the previous one.

Note that most four-bedroom condos are at least 970 square feet, and similarly sized condos average $ 1.3 million (resale) or $ 1.84 million (reboot). we will explain more about this in point 4 below.

In any case, the desire for larger apartments means taking on a larger quantity; and that ultimately means higher loans and down payments.

2. Lots of FOMO purchases

Fear Of Missing Out (FOMO) was an important driving force in 2020 and 2021. This is due to two factors:

First, rising home prices do the trick that – if upgraders wait longer – they end up being pushed out of the market. There is also a feeling that this is a “once-in-a-lifetime” chance to take advantage of the resale apartment price explosion (note that resale apartment prices only declined steadily between 2013 and around 2019).

Current resale price growth is unlikely to be sustainable, driven by temporary factors such as the surge in five-year-old homes or the urgent need for housing due to Covid-19.

As a result, many upgraders fear missing out on good prices for their home; Maybe they ignore that, even if they sell high, they buy high anyway.

Second, there is an underlying fear that rising home prices could lead to government intervention. Some fear that if they wait too long, new credit restrictions or higher stamp taxes will kick in and prevent them from buying.

All of this could lead some buyers to step in long before they have adequate savings. For example, locally, real estate agents have seen buyers turn to banks with higher interest rates simply because those banks are willing to accept higher valuations – a move that could imply an urgent need for higher loan amounts.

3. Low mortgage rates can create the appearance of affordability

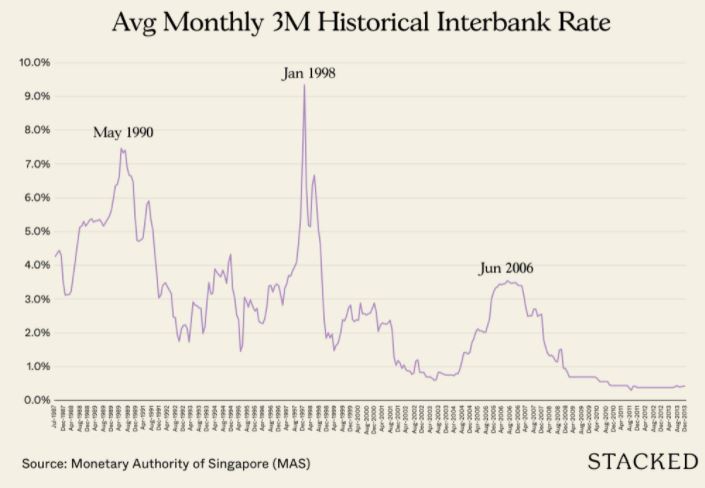

In economic crises, interest rates tend to fall. This is because the US Federal Reserve is cutting interest rates to stimulate its economy.

The last time this happened during the global financial crisis, Singapore mortgage rates fell to record lows. This spurred property purchases due to the low monthly repayments and the prospect of “free borrowing” (ie the home loan interest rate was below the CPF interest rate).

The same thing happened during Covid-19, when mortgage rates fell averaging 1.3 percent per year. This is half of the HDB loan rate of 2.6 percent and is below the applicable CPF rate of 2.5 percent.

The lower interest rate might make it seem affordable. In the US, however, a faster pace of interest rate hikes by the US federal government is now expected from the beginning of next year.

Assuming a $ 1 million mortgage at 1.3 percent, current borrowers would pay around $ 3,906 per month for 25 years. An increase to two percent – the 2018 average – would bring repayments to about $ 4,239 per month; a difference of $ 333 per month.

Before the last financial crisis, mortgage lending rates averaged around four percent per year; and there is no guarantee that we will not come back to it some day. A lot can change over a period of 25 years.

4. CPF spent on down payments to meet TDSR

The Total Debt Servicing Ratio (TDSR) limits a borrower’s loan repayment to 60 percent of their monthly income; For more information on how it works, see our guide. In addition, the TDSR is calculated with an interest rate of 3.5 percent regardless of the actual market interest rate.

Consider a $ 1.6 million condominium. The maximum loan (75 percent) would be $ 1.2 million.

At 3.5 percent over 25 years, this equates to a loan repayment of around $ 6,007 per month. This would require that the borrower have a minimum income of around $ 10,012 per month. This is above the average income of most Singaporeans, and even some double-income families may have difficulty reaching the class.

How do some families deal with it?

The answer is to borrow less (that is, pay a larger deposit). For example, if the borrowers have a combined income of only $ 8,000 per month, their TDSR limit is only $ 4,800.

This is achievable if they bring the loan down to around $ 960,000 for a total of $ 640,000 down payment.

Some might be lucky enough to cover that with the selling price of their HDB apartment, but that’s unusual. Even at the current high price of $ 500, the average five-bedroom apartment is only $ 592,000. Don’t forget that these buyers also pay the buyer’s stamp duty, repayment of the existing home loan, etc.

So here the question arises: where do so many upgraders get the money for the down payment?

It’s hard to give an answer as most buyers are understandably silent about their financial sources. However, there is a real possibility that the regular CPF account will be wiped out to the last dollar (along with the subsequent servicing of the loan) or, in some cases, the in-laws will have to be confiscated.

If so, these buyers will likely go well beyond the 3-5-5 formula, which calls for the home to be capped at five times annual income, 30 percent of their monthly repayments, and for buyers to have 30 percent of the capital they need have in advance.

Of course, many buyers find this far too conservative, so it all depends on your personal risk tolerance.

There are more controls compared to 2008-2013

We do not assume that we will experience an overheated market like in the years 2008 to 2013, when prices rose across the board by around 60 percent. Certain controls, such as TDSR and ABSD, are in place to prevent this from happening.

However, we see many HDB upgrades accepting prices that would have blocked them in 2018 alone.

While private home ownership could be a better appreciative asset in the future, it doesn’t necessarily mean you have to go all out to get the greatest property you can afford.

Remember that the bank or mortgage calculator will tell you the maximum loan amount, not the optimal loan amount.

Most people think they’re making a rational decision because the bank thinks it’s safe (obviously most people won’t think of the worst-case scenario of losing their job), but the reality is that everyone has different thresholds for what is a convenient one monthly installments in relation to the mortgage.

ALSO READ: Older HDB apartments are not depreciating as quickly as you think. The numbers show that

This article was first published in Stackedhomes.