2021 remains an interesting year. First-time owners keep their fingers crossed and hope for a break; while sellers wonder if now is the time to sell (if you sell high, you might buy high, right?)

Meanwhile, the soft rental market is suddenly showing signs of a trend reversal. Here is an update on Singapore’s private property market in the unusual month of August 2021:

What is unusual about August 2021?

In summary we see:

- HDB resale prices rebounded after the June slump

- The highest number of million dollar homes sold in a single month

- A 23.6 percent decline in new condominium sales

- Real estate transaction data has been released

Interestingly, the parking lot at the People’s Park Complex was finally sold in August.

1. HDB resale prices rebounded after the June slump

HDB rents had risen for almost 10 months in a row from August 2020 to May 2021 before falling slightly in June and July. Many buyers, especially first-time buyers, had hoped that this would signal an end to the soaring prices.

However, it turned out to be a temporary effect of a return to Phase II (heightened alarm) and prices are now even higher than they were in May:

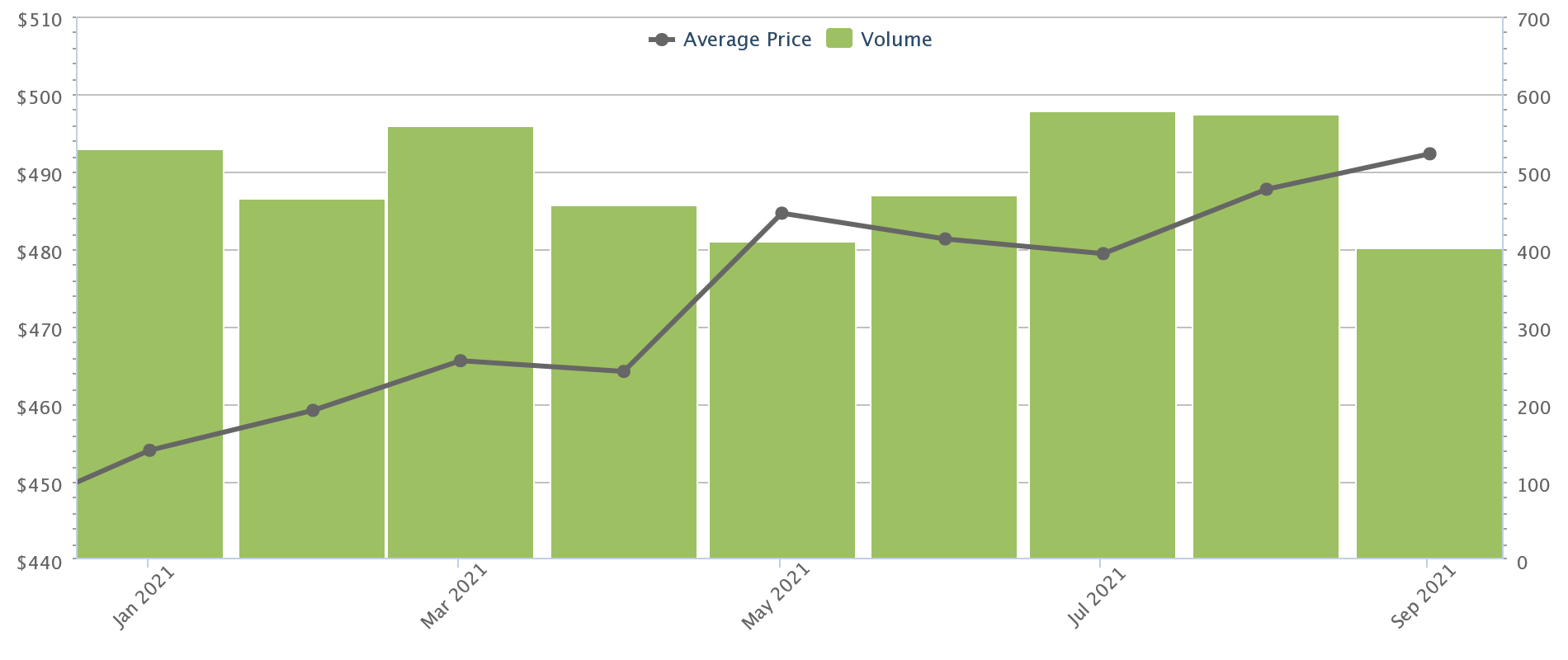

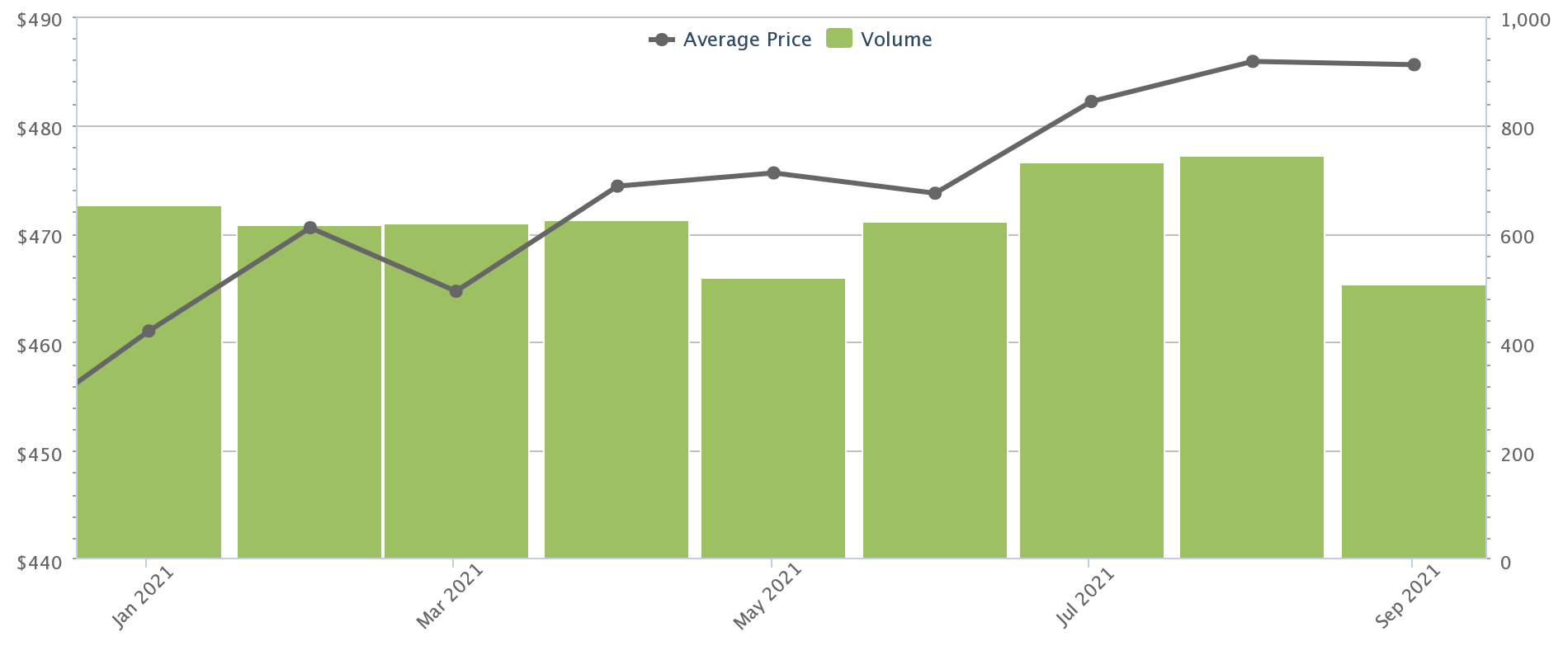

Three-bedroom apartments averaged $ 488 in August 2021, down from just $ 431 a year ago.

4 bedroom homes hit $ 504 psf in August; not yet at their May level of $ 509 psf, but there is a clear bullish trend. That’s an increase from just $ 439 a year a year ago.

Five-bedroom apartments averaged $ 486 after recovering by July. Prices rose from $ 417 psf in August 2020.

Overall, it seems clear that June was little more than a passing speed bump. In fact, resale prices in August are just 0.1 percent below their last high in April 2013.

This is bad news for first time home buyers looking to resell an apartment, and we don’t see any changes in the near future.

Brokers we spoke to cited two main factors driving the price up:

First, the higher PSF price could be due to five year old apartments coming on the market. There is a bumper crop of these units in the market in 2020 and 2021; and these newer resale homes have an extra charge. There is no waiting time to build and the leases forfeiture are negligible (see our list where you are likely to find these).

2. The highest number of million homes sold in a single month

26 resale homes were closed for $ 1 million or more in August 2021. This is the highest value ever recorded for a single month.

Natura Loft, a DBSS apartment in Bishan, recorded the highest transaction for a five-bedroom apartment at $ 1.28 million.

Including August, we saw 151 homes priced at $ 1 million or more. The year is not even over, and we are well past the 82 transactions of the past year.

Keep in mind, however, that millions of homes are still outliers. There were 2,748 resale homes in the month, which means the million-dollar homes accounted for less than one percent of the deals.

ALSO READ: New Product Launches That Cut Prices In 2013/2014: How Are They Now?

3. A 23.6 percent decline in new condominium sales

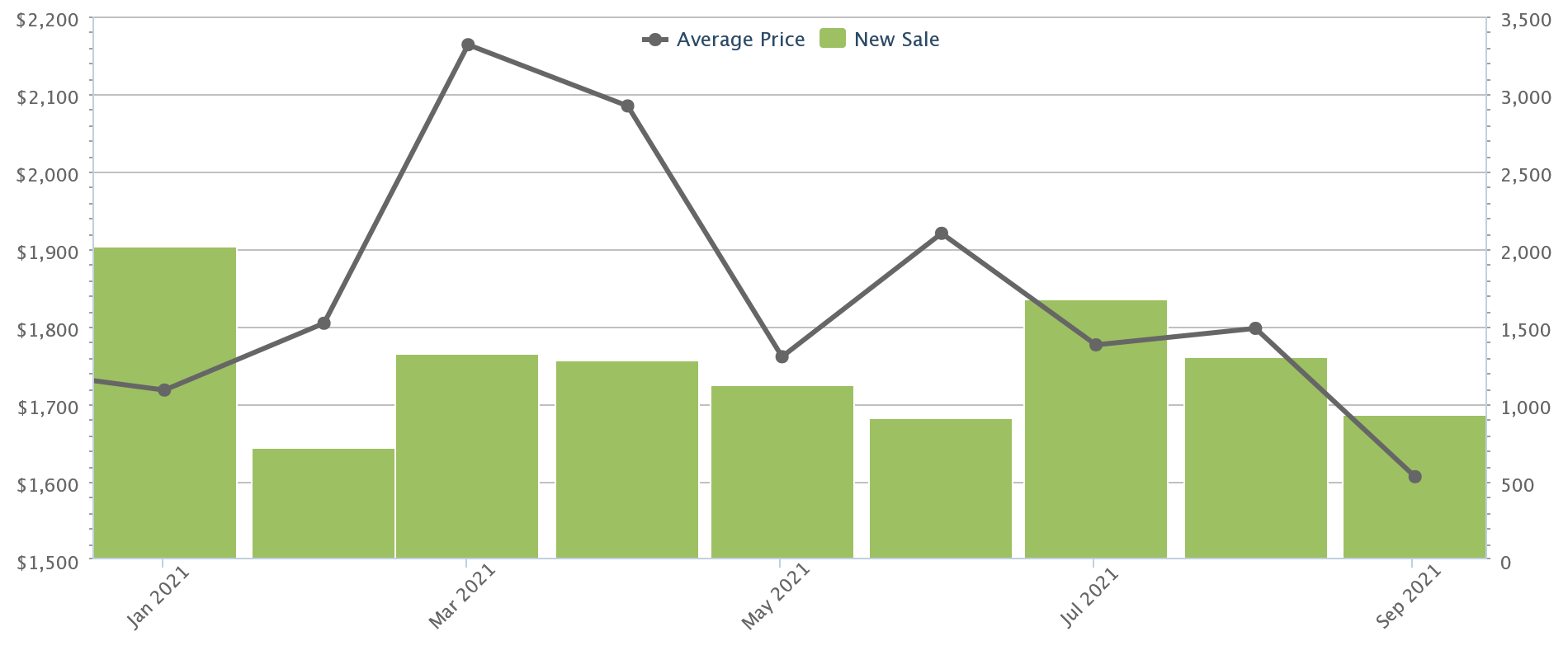

New home sales decreased to 1,215 units in August, up from 1,591 in July; a minus of around 23.6 percent.

However, a decline was to be expected due to the seven-month festival, during which most buyers refrain from buying their own home. However, brokers we spoke to said that in the seventh month alone, the festival wouldn’t have had that big an impact.

(As mentioned above, a record number of million homes were sold in the same month!)

The decline is more due to fewer new product launches. Only around 830 units were launched in August, around 50 percent fewer than a year ago.

Watergardens in Canberra made up the bulk of sales in August with 267 units sold (300 available at launch, 448 total). The current transactions so far indicate a median price of 1,469 US dollars psf.

Normanton Park and Florence Residences were the next two top sellers in August:

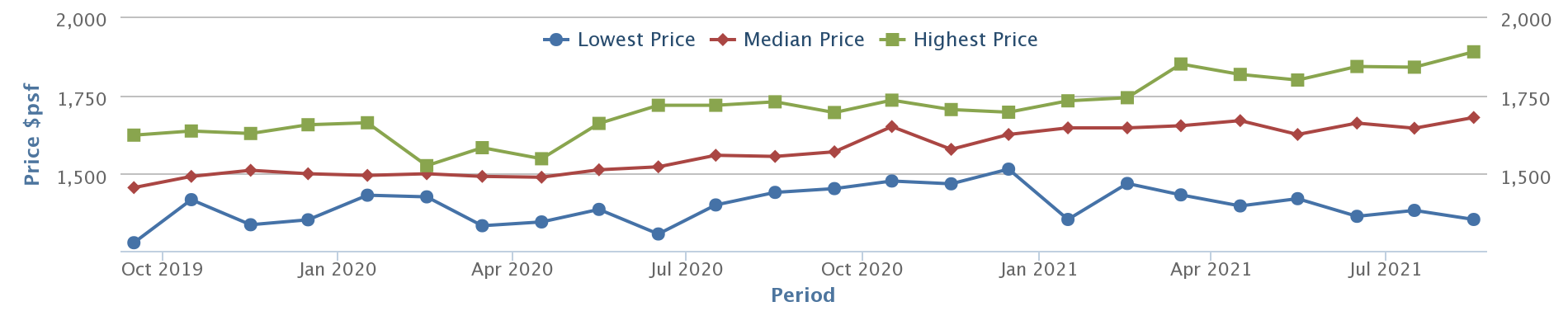

Normanton Park moved an additional 131 units in August and is now 63 percent sold – that’s a pretty good feat considering its early licensing issues (and it’s struggling with 1,862 mega-units). The median price has increased from $ 1,763 at launch to $ 1,828.

The Florence Residences moved 66 more units in August and are now over 84 percent sold. The median price was $ 1,679 psf compared to $ 1,456 psf at launch.

Realtors also told us that in addition to fewer new launches for 2021, attention will be focused on the resale condominium market. This is due to concerns about construction delays, as well as a new trend towards larger homes (older resale condos tend to be larger). .

4. Real estate transaction data has been released

The CEA’s public register is now open. You can use this to review a real estate agent’s most recent transactions in the past 24 months.

The record also shows the property type, whether it is new or resale, and whether the entire unit or rooms have been rented (for rental transactions). Records older than 24 months are also available, but you need to get them from data.gov.sg instead.

[[nid:538940]]

In previous articles we mentioned that you should give preference to agents who have recently transacted in your region or development. This site now has an easy way to find them.

The registry also ensures that you can review each agent’s claims (e.g. if they claim to have sold a unit on your block, you can simply review their records to make sure that was done).

This could potentially create increased demand for skilled agents who have a more established track record – but this is more about transparency and buyers are definitely better off doing it than without.

Since the commissions in Singapore are negotiable, there is a chance that this will result in a slightly larger deviation from the standard commission of two percent. Agents with better history might start charging a little more, while newer agents are likely to stick with the standard rates.

Finally, you might be interested to know that someone bought the parking lot at the People’s Park Complex

Lucky Pineapple (a Far East Organization company) bought the multi-story parking garage for $ 39.33 million; a little less than the $ 42 million price we saw for it.

This is about $ 195 psf, with $ 1,533 psf for the restaurant unit that is in the parking lot. That’s a reasonably good deal, even if the whole development only takes 46 years; Parking is one of the few options for motorists in the area (if you’ve tried driving in Chinatown, you know what we mean).

In addition, the en bloc prospects are high due to the central location.

This article was first published in Stackedhomes.