You are in an exciting part of your life when you are in your 20s. In this phase you finish your education, start your career and make plans for your future. On average, people in their twenties are just starting to make money and most likely will be single and still living at home.

In some cases, you can rent an apartment or live in a condominium. The most important thing about this age group, however, is that financial independence is still a relatively new concept and, unlike in previous years, the burden of bills has shifted from parents to young adults.

So what are the best financial products for people in their twenties? We explore below.

Statistics of 20 to 29 year olds in Singapore

- 13 percent of Singaporeans are between 20 and 29 years old

- 80.5 percent of men and 66.9 percent of women between the ages of 25 and 29 are single

- The median monthly income (excluding CPF) is $ 2,405 for people aged 20-24 and $ 3,468 for people aged 25-29

- 20.9 percent – 25.7 percent of households where the main breadwinner is in their twenties own a car

- Households with the main breadwinner in their twenties spend $ 4,200.80 to $ 4,549.20 per month ($ 2,100 to $ 2,275 per person)

- Only two percent of all households are run by Singaporeans in their twenties.

Debit and credit cards should be used for credit building and good buying behavior

If you are currently in your first job or are working part time while in school, then the best credit or debit card for your needs is one that suits your spending habits, has low fees, and does not require high monthly expenses.

As you advance in your career and earn more, you can upgrade to a card that may be charged an annual fee in exchange for higher cashbacks and rewards. Since credit cards typically have a minimum income of $ 30,000, college students can do better with a debit card.

An example of a student-friendly debit card is the DBS Visa Debit Card, which offers three percent cashback on online food orders (perfect for the busy student), one percent on all local expenses, and a low monthly minimum of $ 500.

Examples of credit card picks for over 20

If you’re making above the minimum annual salary required by most credit card accounts, look for cards that have low annual fees and offer rewards for doing things that are important to you (grocery shopping, activities, online shopping, etc.).

Two examples are the OCBC Frank Card and the Maybank Platinum Visa. Both waive their annual fee if you spend a decent amount each year, and offer either discounts or cashback on things most young adults need, such as online spending, mobile contactless spending, and foreign exchange transactions.

[[nid:527110]]

For young university students looking to improve their credit scores, you can look for credit cards with low credit limits to avoid over-spending. An example can be the Maybank eVibes card, which has a low monthly limit of $ 500 but still offers generous rewards and perks.

When you’ve graduated from college and been in a high paying career for several years, your credit card requirements will change. At this stage in your life, you will have stable income and take control of more bills. Maybe you’ve found a partner and share a home.

In this case, a card like the UOB One Card is a suitable upgrade. This is because, in addition to the five percent flat-rate discount, it also offers cashback for things you’ve already paid for, like Grab, Shopee, utilities, and travel.

It is more suitable for younger people with stable careers than university students as it maximizes premium rates when spending at least $ 2,000 per month.

Saving is a priority so choose the best savings accounts

If you are quite young and live with your parents, you don’t have to worry about big bills like mortgages or car loans. Because of this, you should focus on saving as much as possible for your future goals like an apartment, a wedding, or a car.

As a rule of thumb, you should take home about 20 percent of your salary, or about $ 481 to $ 694 a month.

[[nid:524452]]

At this point, you may also not have a large amount of loose change to put in high-yield savings accounts, CDs, or investment portfolios. So it’s a good time to start saving with simple savings accounts.

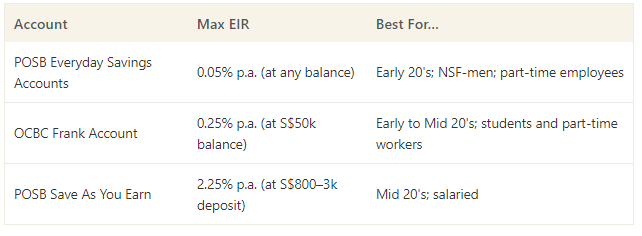

At this age, we recommend looking for savings accounts that have low balance fees, no minimum deposit requirements, and high daily credit.

A couple of examples are the POSB Everyday Savings Account, which can be good for NSFs or people under 21, and the OCBC Frank Savings Account, which also has no minimum deposit, falls below the fees and has no average daily minimum balance for the account holder younger than 26 .

Examples of savings accounts from 20

Finally, another type of savings account that can be useful when you’re in your 20s is one that automatically deducts savings from your paycheck. An example of this is the POSB Save As You Earn account, which is linked to your POSB or DBS debit account.

Every month the amount you requested will be transferred to the PAYE account. You will also be rewarded with higher interest rates for depositing more than $ 300 per month, which is useful if you are still learning to be financially responsible and want an incentive to save.

Insurance should focus on value

If you are starting your career and looking to become self-employed, insurance is also required. In most cases, insurance plans come in handy when you own property and have stable income.

By your mid-twenties, there aren’t a lot of insurance that is really needed other than health insurance, serious illness insurance, and all the compulsory insurances like home and car.

First, health insurance makes sense as it offers full coverage (minus the co-payment) when you are hospitalized.

In the case of health insurances, we recommend that you check which is the most affordable for your age group and preferred hospital ward. For the most part, we’ve found Prudential to be most beneficial for the average, healthy young professional.

Examples of insurance plans for over 20

If you are among the 20-25 percent who own a car at this age, it is also worth looking into car insurance instead of looking at plans that you may have received from the dealer.

As with any insurance, you should pay attention to premiums and coverage as there are tariffs on the market that are cheaper for your age group or have a lower deductible for young drivers.

For example, you can opt for Aviva’s Lite car insurance, which offers comprehensive coverage at rates that are 30 percent cheaper for drivers in their twenties compared to the market average.

They also offer MINDEF drivers an additional 15 percent discount. If you have an excellent driving record, you can go for price over coverage. For example, Budget Direct offers one of the lowest premiums on the market and allows you to customize coverage so that you only pay for what you need.

Should you get life insurance?

There are some proponents of getting term life insurance while in your 20s. The theory is that you can get cheaper rates and be young and healthy enough not to be denied coverage due to previous age-related illnesses.

But do you really need to spend money on life insurance at this age, even if it’s as simple as direct purchase plans?

If we look at the statistics, we can see that the death rate among 20 to 39 year olds has decreased between 70 and 83 percent, and all four age groups currently have a death rate of 0.5 or less per thousand.

[[nid:458468]]

That, along with the fact that DPI term life insurance only costs between $ 7 and $ 187 more per year to buy in your 30s than in your 20s, it might make more sense to save your money and think about life insurance when you are established and have loved ones.

Other plans discussed for young professionals are serious illness and accident insurance. Both types of insurance plans can be found as annual renewal plans, which makes them low in commitment compared to life insurance.

If you look at the statistics, cancer is the number one critical illness and killer in Singapore, and with 7.6 percent of cancer diagnoses occurring in people under 40, serious illness insurance might be considered if you are really concerned to be able to afford cancer treatment.

If, on the other hand, you are concerned about covering treatment costs in the event of an accident, private accident insurance can be an alternative. With either policy, however, it is best to choose the cheapest tariff available for the amount of coverage required.

Other useful finance tools for young adults: brokerage and finance apps

Once you start budgeting and saving, there are a few tools that can help you with that. If you are knowledgeable about stocks and want to invest your savings, you can go with an online brokerage.

[[nid:523183]]

Unless you have extensive experience (through your job) in the stock market, we recommend that you purchase an entry-level account such as moomoo (offered by FUTU) or Tiger Brokers for a small fee.

Since you’re younger and can take more risks, investing in stocks can be a great way to increase your savings rather than just keeping them in a low-yielding savings account.

You should just be sure to do your due diligence before investing as there is always a risk of losing money.

However, both brokers also provide clear information on trading rules and risks, as well as market insights to help you make informed investment decisions.

Examples of online brokerage for 20 year olds

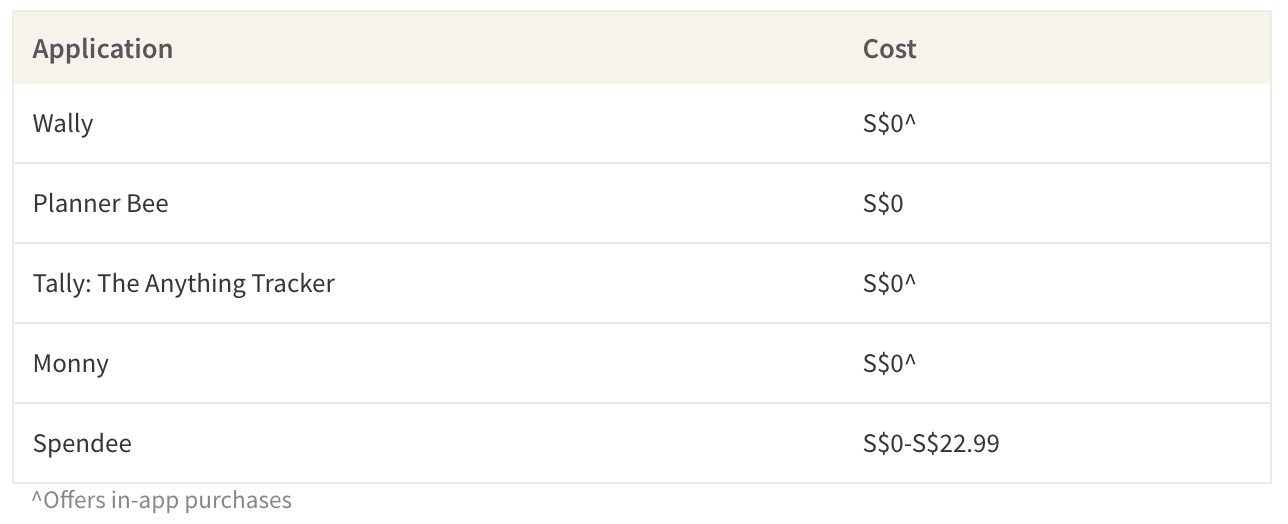

Another thing to get are budget apps as they are very useful in keeping your finances on track. Many are free and you can use them to track expenses, savings, and find out how to optimize your budget.

What should be in your finance portfolio?

In summary, students and young professionals should at least be equipped with a starter credit card, savings account, basic health or term life insurance and some useful financial planning apps.

Young adults with higher consumption incomes and good market knowledge can also choose a simple, low-fee brokerage account to increase their savings.

Below is a sample portfolio of financial products that may be useful for students and young professionals. Please note that these are examples of products that may be a good fit based on the profile of an average 20-29 year old in Singapore.

Your specific needs may vary, so these products are not recommendations or prompts.

This article was first published in ValueChampion.