The land real estate market saw a strong recovery in the fourth quarter of 2020. At the time, we heard many market watchers speculating that land prices would soon be falling. It only took a while for the effects of Covid-19 to bite.

Well it hasn’t happened yet. and so far the demand has been relentlessly high. Case in point: the sale of a $ 128.8 million Good Class Bungalow (GCB) along Nassim Road in the first quarter of this year for a staggering price of $ 4,005 psf.

And barely two months have passed since then – and this record has been reported to have been broken. A GCB on Cluny Hill is in the early stages of a sale at $ 63.7 million or a potentially new record of $ 4,291 psf.

It’s breathtaking.

Great news if you are selling a landed home. But if you’re just trying to upgrade to a landed home now, take a deep breath. Sellers do not move away from asking prices. and the specter of new cooling measures is looming:

What is happening to the real estate scene in Singapore?

Edmund Tie mentioned in the Straits Times that properties landed for the first quarter of 2021 defeated unlanded counterparts for the quarter. This was a comparison of profitable and unprofitable transactions between the two (see their general conclusions in the article linked above).

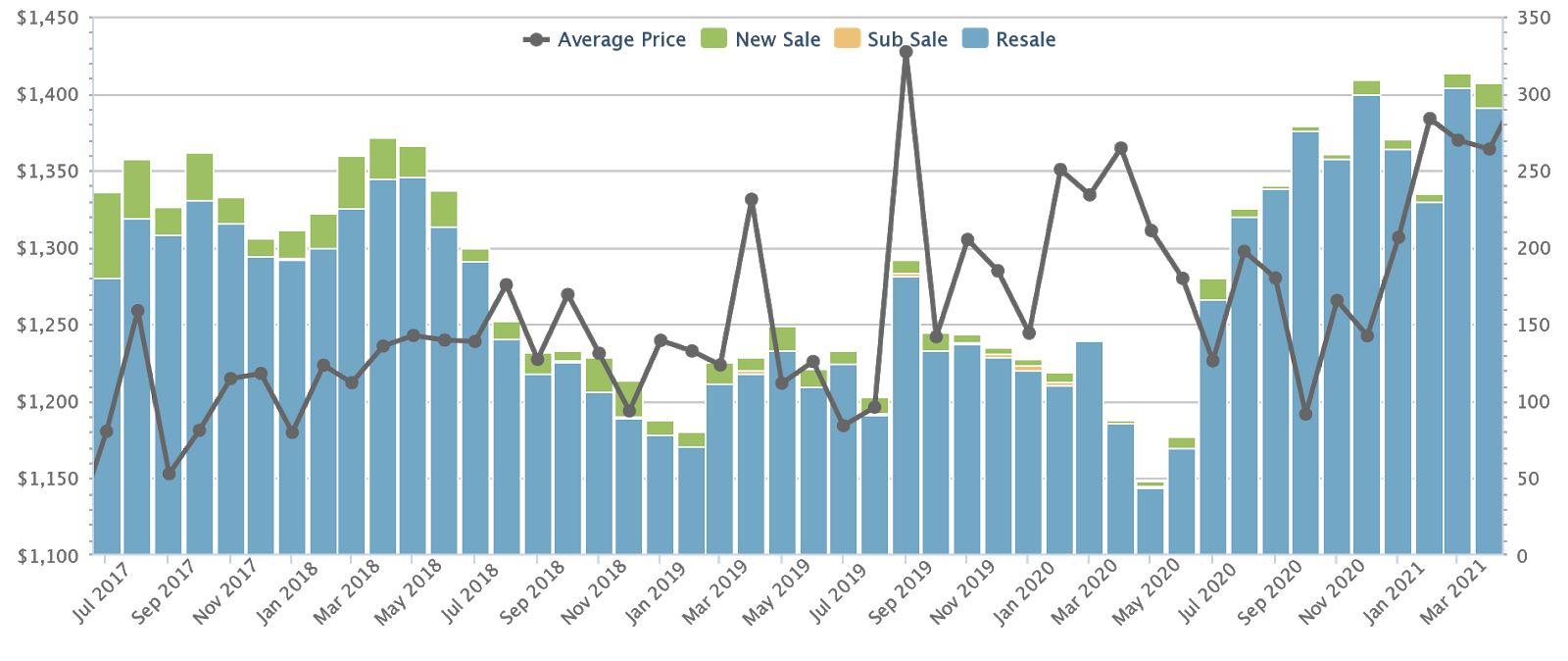

To get an idea of actual prices and volumes, we’ve looked at transactions across the island over the past 12 months:

Based on data from Square Foot Research, the total price psf was unchanged at 1,364 psf (up from $ 1,365 a year ago). What has increased is the number of transactions.

At the end of April 2021, there were 306 real estate transactions. This is the highest value we’ve seen in a while.

The low volume from April to July 2020 is due to the circuit breaker. This started on April 7, 2020 and ended on June 1, 2020. Note, however, that as of August 2020, land transactions have not fallen below 200 units for nine months.

We haven’t seen such transaction numbers between July 2017 and June 2018, shortly before new cooling measures were initiated:

Single-family homes have seen the greatest revival since the breaker ended

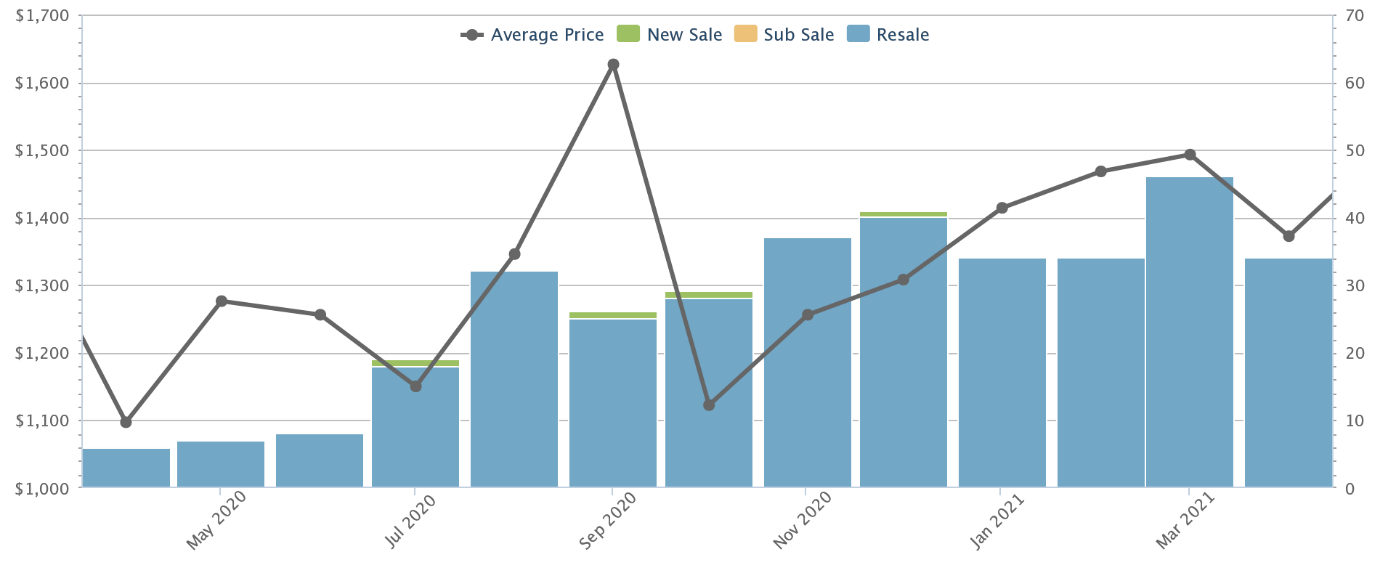

Single family homes have seen strong sales volumes since the breaker ended.

In March 2021 in particular, 46 transactions were carried out. This is the highest single-family home transaction volume in around 10 years, although the number fell to 34 over the next month.

Single-family home prices now average 1,372 psf, compared to $ 1,097 for the same time last year. This is an increase of around 25 percent.

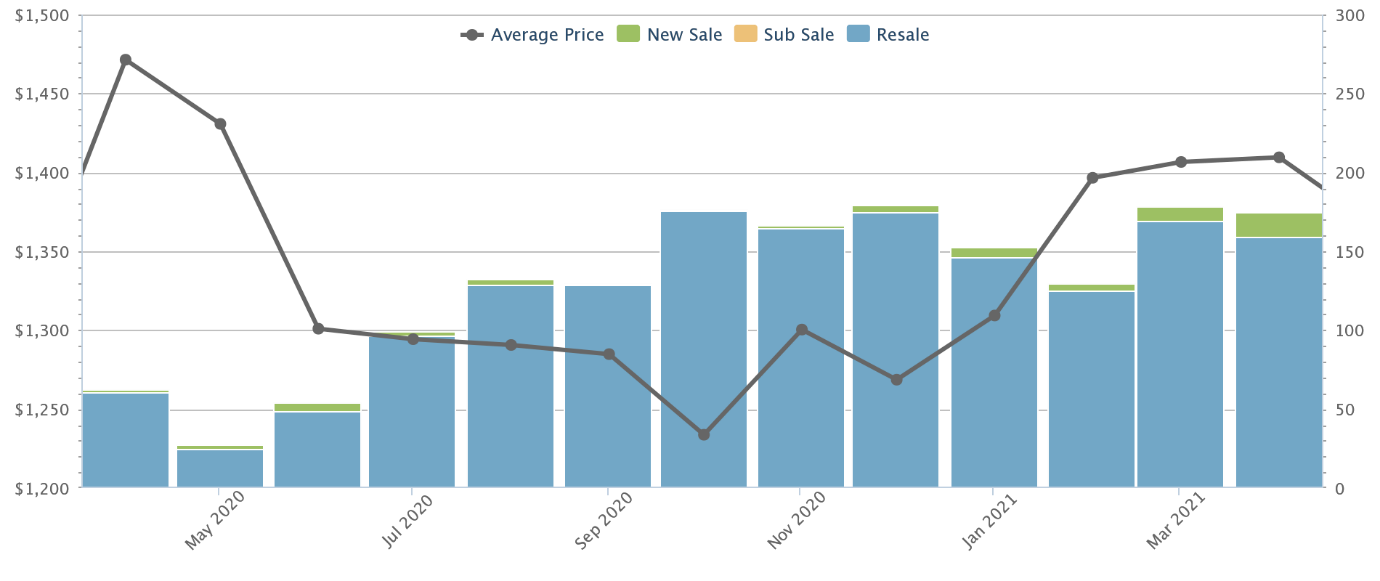

Semi-detached houses also recorded the highest transaction volume in around 10 years and reached 98 transactions at the end of April 2021:

Semi-detached house prices now average 1,280 psf, compared to 1,100 psf at the same time last year. This is an increase of around 16 percent.

Source: Square Foot Research

Row houses did not see as dramatic revival compared to their other landed counterparts. At the end of April 2021, they hit 174 transactions while the average price dropped from $ 1,471 to $ 1,410 psf.

Overall, we can see that larger country houses (semi-D and detached) were the highlight of the year.

However, there is a large discrepancy between ownership and tenant land

Local agents warned that country house pickup was one-way. Some of them said that demand was almost entirely for condominiums, with leasehold plots showing rather poor sales.

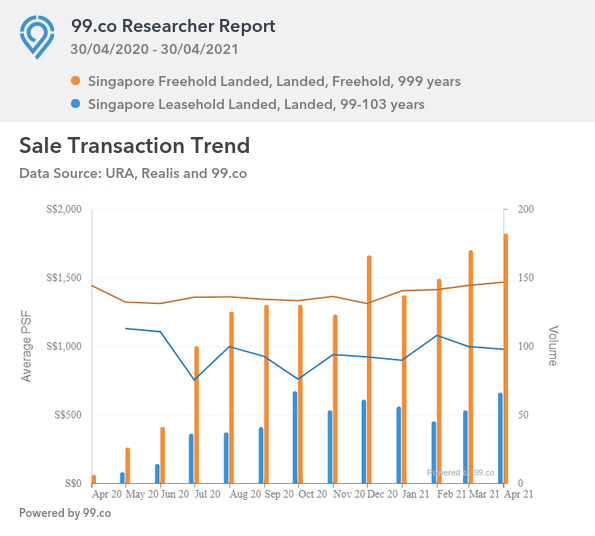

We looked up at 99.co to see the price movement between property and lease (we used a different data source as that distinction between lease and property was not with Square Foot Research):

As you can see, condominiums made up the bulk of transactions each month (this could also be due to the larger supply). Property price movements were largely unchanged, ranged from $ 1,441 to $ 1,465 psf over the course of the year. In the case of leased houses, however, prices have fallen by over 13.4 percent. from $ 1,128 in May (no transactions in April) to $ 977 in April 2021.

One of the realtors we spoke to pointed out that Sentosa Cove is helping:

“The problem is, the ABSD for foreigners is currently 20 percent, or about $ 840,000 in tax at an average price of $ 4.2 million. Foreigners find the prices in Sentosa Cove too high, and we Singaporeans all want property landed. “

ALSO READ: From an EU to a 999 year old country house: How I helped my clients realize their dream home

Other brokers pointed out that real estate buyers look for generational assets. A landed home is the final stop on the path to wealth development, and buyers often want it to last their descendants for generations to come. Leases, however good they are, cannot serve this purpose. Hence, it is unlikely that lease prices will rise again anytime soon.

This could be a silver lining for some readers. If you are looking for a landed home and you don’t mind leasing, you may not have to compete with too many others. Give us a call and we can help you find the best options.

Is the trend for country houses likely to continue?

As always, there is no such thing as a perfect crystal ball. However, the general consensus among analysts and brokers is that demand for land – other than new cooling measures – is unlikely to decrease. This is due to three main causes:

- Afraid of new cooling measures

- Lower interest rates

- An investment in a safe haven

1. Fear of new cooling measures

At the moment we are in danger of taking new cooling measures. Some buyers (e.g., those looking to move into a country house while keeping and renting out their existing apartment) will now feel driven to action. before new credit restrictions or higher ABSD rates occur.

An increase in the volume of transactions – especially in the case of high-quality real estate such as land – is often seen as a red flag. For example, the last round of cool-down measures (July 2018) took place after real estate transactions exceeded 200 units for several months in a row.

While some may also say at this point that the current new measures are naturally affecting the number of views, it could actually be some form of cool-down measure that can slow things down.

2. Lower interest rates

Currently, home loan interest rates range from 1.2 to 1.3 percent per year. This is because the US is cutting interest rates domestically to stimulate its economy in a downturn. Covid-19 will have an after-effects for years due to the number of businesses closed and job losses.

Hence, it is likely that we will see low interest rates for a long time to come. As a reference, interest rates were last lowered in order to cope with the global financial crisis of 2007/08. Rates had not returned to normal until 2020 when the pandemic hit and sent them back down.

For some investors, an interest rate lower than the CPF risk-free rate of 2.5 percent is considered “free borrowing”.

3. An investment in a safe haven

Similar to 2007/08, investors who have liquidated other assets – such as their equity portfolios – are not always keen to leave them with the bank. With interest rates bottoming out, they need to find something else to invest in.

While there are a number of alternatives (gold, pension funds, etc.), Singapore real estate is one of the most notable assets on this list. This is especially true for Singaporean investors who have learned – historically and culturally – to view real estate as part of retirement planning.

Country houses are seen as an ideal good as new condominiums and apartments are being built all the time. But actual houses are so rare (around five percent of the current housing stock) that there is never a supply problem.

But if all you want is a landed home for the space, there are alternatives

Don’t forget that there are also condos with lots, like the mansions in Normanton Park. Yes, they are not “real land”, they have maintenance fees, and they are mostly leases – but if you don’t focus on investment returns, is that really a major disadvantage?

These units still have the space you need with the added bonus of pools, gyms, 24/7 security, and all of the usual condominium perks.

Some of the condos with lots at the moment are:

- The veranda residence

- Normanton Park

- Clematis Park

- Kent Ridge Hill residence

- Park suites

- Leedon Green

ALSO READ: Would you like to own a piece of Singapore’s history? Rare property for sale in Oxley

This article was first published in Stackedhomes.