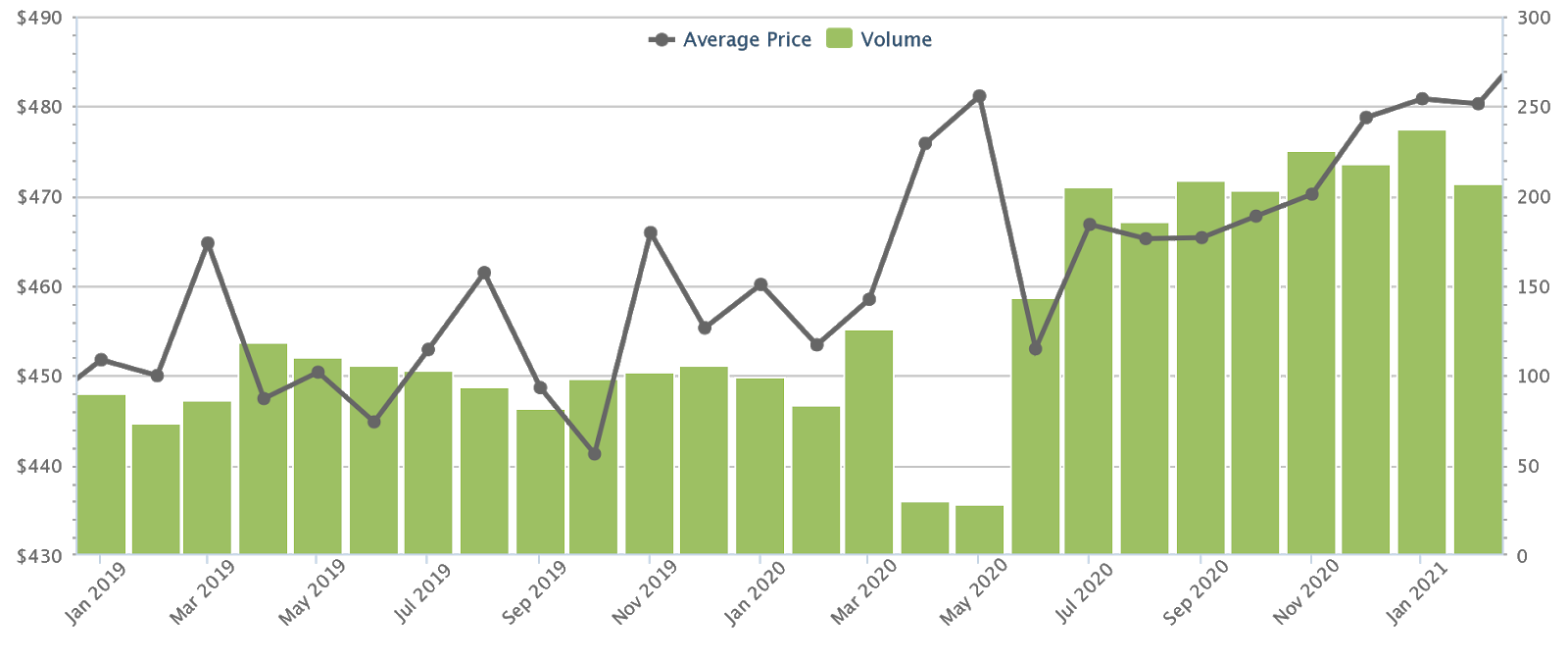

The prices for reselling apartments are at an eight-year high. However, market observers saw this as early as October 2020. At this point in time, the volume of resale transactions was at its highest level since 2010; and the momentum doesn’t seem to be slowing down.

This week we took a look at the hottest HDB cities by the sheer volume of resale transactions. and the names may surprise you:

HDB cities with the highest resale volume

The following information is based on the total resale transactions between January 2020 and February 2021:

Highest increase in transactions overall:

| HDB city | Total number of transactions recorded | Increase volume | Percentage increase | Average price (as of February 2021) |

| Punggol | 2.090 | 252 | 146 percent | $ 480 psf |

| Line | 2,414 | 105 | 33 percent | $ 443 psf |

| Choa Chu Kang | 1,015 | 77 | 65 percent | $ 402 psf |

| Toa Payoh | 792 | 72 | 84 percent | $ 561 psf |

| Bedok | 1,478 | 69 | 37 percent | $ 459 psf |

Highest increase in transactions for 3-room apartments

| HDB city | Total number of transactions recorded | Increase volume | Percentage increase | Average price (as of February 2021) |

| Clementi | 318 | 25th | 89 percent | $ 492 psf |

| Ang Mo Kio | 603 | 23 | 30 percent | $ 405 psf |

| red hill | 353 | 21 | 50 percent | $ 548 psf |

| Toa Payoh | 375 | 20th | 53 percent | $ 398 psf |

| Kallang / Whampoa | 306 | 18th | 53 percent | $ 434 psf |

Highest increase in transactions for 4-room apartments

| HDB city | Total number of transactions recorded | Increase volume | Percentage increase | Average price (as of February 2021) |

| Punggol | 1.185 | 140 | 156 percent | $ 479 psf |

| Line | 1.281 | 57 | 32 percent | $ 452 psf |

| Choa Chu Kang | 539 | 41 | 61 percent | $ 412 psf |

| Queenstown | 342 | 37 | 116 percent | $ 798 psf |

| Bedok | 557 | 25th | 36 percent | $ 465 psf |

Highest increase in transactions for 5-room apartments

| HDB city | Total number of transactions recorded | Increase volume | Percentage increase | Average price (as of February 2021) |

| Punggol | 651 | 94 | 168 percent | $ 469 psf |

| Line | 948 | 53 | 47 percent | $ 425 psf |

| Bedok | 279 | 29 | 74 percent | $ 486 psf |

| Toa Payoh | 168 | 28 | 165 percent | $ 685 psf |

| Choa Chua Kang | 395 | 26th | 59 percent | $ 385 psf |

What is unusual about the resale market in 2020-2021?

A combination of two factors supports the HDB resale boom. Firstly, we have a shock crop of around 50,000 apartments that have reached their minimum occupation period (MOP) in these two years. Among these are very sought-after five-year-old apartments as they have the advantage of being built but with negligible rental decline.

The second factor is Covid-19, which causes some buyers to be more conservative than usual. For example, some buyers have moved from their existing home to a larger or better located resale home rather than a new condominium. This increases affordability while alleviating worries about construction delays.

Hence, we would expect the HDB resale market to maintain its momentum for the remainder of 2021. However, not all HDB cities benefit proportionally. The following cities are doing better (see above), and these are some likely reasons:

1. Punggol

After the break of the break, Punggol has managed to maintain a transaction volume of more than 200 units per month with the exception of August 2020. In contrast, there was not a single month in which Punggol resale transactions exceeded 118 units.

One reason is simply the number of apartments MOP is reaching in this city. An estimated 5,206 homes in Punggol will reach the MOP in 2020/21, the third highest number behind Choa Chu Kang and Sengkang (see below).

The second factor is the growing awareness of the Punggol Digital District (PDD) and the likely magnitude of the impact. This is a corporate district where the Singapore Institute of Technology (SIT) will merge with technology companies and test facilities. There will also be Nexus, a large mall next to the upcoming Punggol Coast MRT station. Those who have seen the transformation of the One North Tech Hub and its impact on neighbors like Clementi expect a similar phenomenon.

Finally, completing Waterway Point solves many of the longstanding problems here. While not new (Waterway Point was announced in 2011 and completed in 2016), the roughly 542,493 square foot mall solves many of the conveniences that once plagued Punggol (it is now very crowded). The Boardwalk (which connects the mall to Waterway Park and the MRT) is a much-needed hub for retail, dining, and family recreation.

Punggol feels a lot less sparse compared to a few years ago, and delays pile up in the district as they finally notice the changes (delays because, as you can see above, prices have gone up significantly since 2019).

2. Dash

From August to January 2020, Sengkang mainly conducted resale transactions over 240 units per month. The exception would be November (still 221 units) and finally a drop in February to 205 units. For comparison, Sengkang never managed to exceed 193 transactions for any given month for the whole of 2019.

With around 6,618 units, Sengkang has the highest number of apartments to achieve MOP for 2020/21. This is due to the massive developments in the Fernvale region from 2015 onwards. Fernvale Rivergrove and Fernvale Lea alone have an estimated 2,678 homes reaching MOP.

While Sengkang is far from mature, it is actually one of the best connected cities.

From the beginning, Sengkang’s HDB projects were built together with the public transport hubs. As a result, Sengkang’s LRT system is top-notch, connecting Sengkang MRT station, bus interchange and Compass One shopping mall in a single point. Sengkang also has two MRT stations on the North-East Line (NEL), with Buangkok MRT station in Sengkang City.

Age can also have something to do with the popularity of the area. Sengkang is associated with younger families – this has a reputation for being lively and dynamic rather than simply “ulu”. It’s a benefit cities like Sembawang and Punggol have never experienced.

By the way, an overlooked aspect of Sengkang is the Seletar Aerospace Park. This is a much underrated place to eat and relax.

3. Choa Chu Kang

Choa Chu Kang has the second highest number of apartments to reach MOP (around 6,250 units). Most of it comes from Keat Hong, who has moved aggressively over the past decade. Over 4,800 resale homes reaching MOP are all from this general area.

Choa Chu Kang is one of the more affordable HDB cities with average resale prices of 402 psf; By comparison, the Singapore average in February 2021 was 468 psf. Note above that Choa Chu Kang’s 5 bedroom apartments cost an average of 385 psf, making them one of the most affordable housing options for larger families.

ALSO READ: HDB Prices in 2021: Up or Down?

Ironically, in February, Choa Chu Kang also saw the most expensive single sale transaction for an immature property. That was $ 890,000 for a rare maisonette at 64 Choa Chu Kang Street. However, this was an outlier that doesn’t reflect the entire resale market here.

Choa Chu Kang is currently benefiting from the development of the railway corridor that extends over the eastern edge. Note that completion is scheduled for 2021, so there is almost no waiting time for home buyers moving this year.

Choa Chu Kang won’t be cheap for too long; We assume that prices will reach the island-wide average from 2025/26. At this point, the Jurong Rail Line (JRL) is nearing completion and provides better access to Jurong East’s retail hub.

4. Toa Payoh

Toa Payoh has seen a surge in interest in its larger 5 bedroom units. Prices hit a remarkable 685 psf in February. Previously, Toa Payoh had seen four resale homes hit the million dollar mark in January. These were for 5 bedroom DBSS apartments at The Peak.

That said, we probably don’t need much explanation as to why Toa Payoh (and neighboring Bishan) are shallow hotspots for resale – that has been around for many years and probably many more.

This is thanks to the location on the outskirts and the extensive amenities. The Thomson Line with Brighthill, Upper Thomson and Caldecott MRT has helped improve connectivity for Toa Payoh and Bishan alike. Hence, even the higher prices do little to deter buyers. HDB upgrades in particular (considering that many have the funds to buy a condo, a Toa Payoh resale unit is within their means).

5. Bedok

For all of 2019, it was rare for Bedok to cross 101 transactions. This only happened four times in July, September (barely 104 transactions), October and November.

After the breaker, however, the resale transactions in Bedok remained over 130 monthly transactions with the exception of November 2020 (122 units) and recently February 2021 (117 units).

However, Bedok is difficult to generalize due to its astonishing size – this is the largest planning area in Singapore, stretching from Changi across the Bedok Reservoir to the border lines of Eunos and Pasir Ris. Given that this is such a large, mature area, it is not surprising that many housing resale transactions will be somewhere within their boundaries.

Thanks to the increasing development of the connecting area Tanah Merah Kechil, we would expect continued interest in Bedok North and Bedok South in the coming years. Tanah Merah, as a connection point to Changi Airport, will also help maintain interest.

Is the rise in the resale market sustainable?

There is a growing preference for resale homes as primary homes as more Singaporeans move into the private market.

The MOP countdown starts after completion, not after purchase. This means that when buying a BTO apartment, the time to sale is typically eight to nine years (around three to four years for construction plus a five-year MOP). In a resale apartment, there is only the MOP to deal with. Given that private property prices tend to rise faster than flat rates, many upgrades are feeling urgent.

However, the volume of transactions is likely to weaken until 2022/23 as the harvest from resale apartments is absorbed.

This article was first published in Stackedhomes.