You are ready to make your money work for you by investing it. Big!

Before you can begin, however, you need to decide which investment broker to use. A lot of people get lost and then give up before they even start.

Saxo Markets’ SaxoTraderGO is a platform that enables you to buy and sell assets such as stocks, ETFs, funds, bonds, options, futures, forex and CFDs online.

Let’s see how his platforms measure up.

What is Saxo Markets?

Saxo Markets is a subsidiary of Saxo Bank, a Danish investment bank. For many, that’s enough to dispel doubts about the company. Its trading platform SaxoTraderGO is used by investors around the world.

The good thing about Saxo Markets is that their fees are pretty cheap compared to other brokerage firms. More about the fees below.

In addition, it has an international outlook and is great for those looking to invest in overseas markets or exchanges, although you can of course stick with SGX stocks as well.

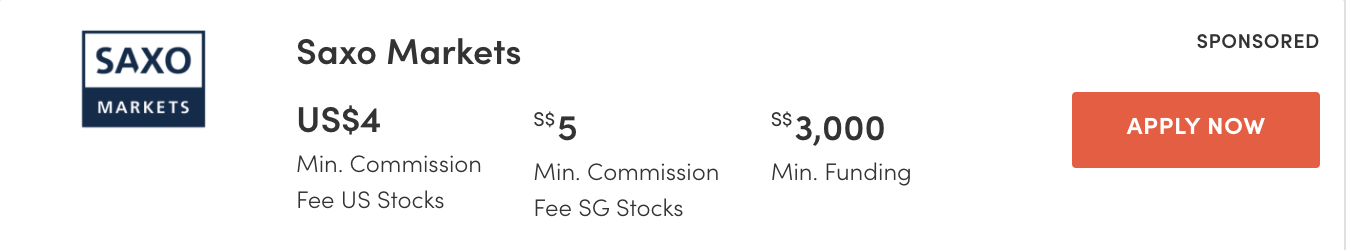

Saxo Markets overview: fees, products, trading platforms

| Commercial products | Stocks, ETFs, Bonds, Commodities, Options, Futures, Funds, FX and CFDs |

| Minimum commission fee (SG shares) | $ 5 |

| Minimum commission fee (US stocks) | $ 4 ($ 5) |

| Minimum funding amount | $ 3,000 (classic account) / $ 300,000 (platinum account) / $ 1,500,000 (VIP account) |

| Storage type | Custodian |

| Trading platforms | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO |

| Payment method | FAST, PayNow, MEPS, internet bank transfer or credit / debit card |

| Inactivity fee | None |

Saxo Markets Commission and Trading Fees

High commission fees can really bite your butt if you buy and sell frequently.

One of Saxo’s greatest strengths is its affordable fees – it costs 0.08 percent to trade Singapore stocks, compared to others that charge around 0.18-0.275 percent.

This is what it costs to trade stocks on different markets with the classic plan:

| Saxo Markets Fees | |

| SGX trading fee | 0.08 percent with a minimum of $ 5 |

| New York Stock Exchange trading fee | 0.06% with a minimum of $ 4, and a maximum of $ 100 |

| Hong Kong Stock Exchange | 0.15 percent with a minimum of HKD $ 90 (S $ 15) |

| Australian Stock Exchanges Dealing Fee | 0.10 percent with a minimum of AUD $ 8 (S $ 8) |

| Tokyo Stock Exchange trading fee | 0.15 percent with at least JPY 1,500 (S $ 18) |

| Forex fees | 0.7 pips for EUR / USD, 1.1 pips for USD / SGD |

| Platform fee | None |

Note that these fees are applied to both purchases and sales (some brokers only charge commissions on purchases).

Platinum and VIP account fees are 0.01 to 0.03 percent lower for stocks in non-Singapore markets.

In addition to these fees, you must pay a custody fee of 0.12 percent per annum for all stocks, ETFs and bonds not listed on the SGX. There is no custody fee for SGX instruments.

How can you invest with Saxo Markets’ platforms?

| Saxo platforms | For whom is that | Products |

| Saxo Investor | Simple user interface for beginners just trying it out | Cash products, stocks, ETFs, bonds, mutual funds |

| SaxoTraderGO | Comprehensive one-screen dashboard for investors with a little bit of knowledge | FX, FX options, CFDs, stocks, ETFs, futures, listed options, bonds, mutual funds, commodities |

| SaxoTraderPRO | For advanced institutional traders | FX, FX options, CFDs, stocks, ETFs, futures, listed options, bonds, mutual funds, commodities |

Saxo has three main platforms through which you can invest: SaxoTraderGO, SaxoTraderPRO and SaxoInvestor.

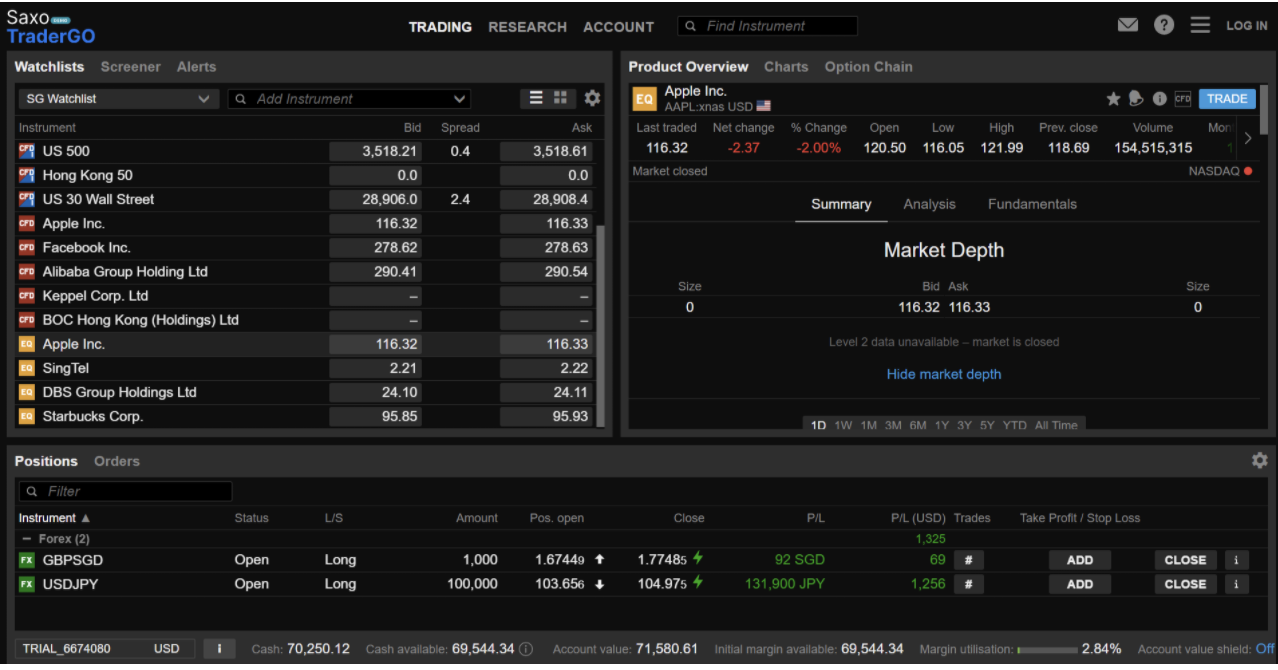

SaxoTraderGO is Saxo’s most popular consumer-facing trading platform that makes it easy for users to manage investments from a wide variety of asset classes, currencies and countries.

You will see consolidated breakdowns and statistics giving you a comprehensive overview at a glance, even historical reports on your net inventory. Overall, it’s a solid platform, especially if you’re looking to trade forex or foreign stock markets.

You don’t need to apply for a CDP account to use SaxoTraderGO. However, you can transfer your shares from your Saxo account to your CDP account.

The catch is, you cannot transfer shares from your CDP account to your Saxo account. So if you want to sell them through SaxoTraderGO you will need to keep them on your Saxo account.

SaxoTraderPRO is a slightly more advanced platform with features designed for advanced traders or institutional traders. The advantage of SaxoTraderPRO is that there are no typical fees for institutional trading apps.

[[nid:542540]]

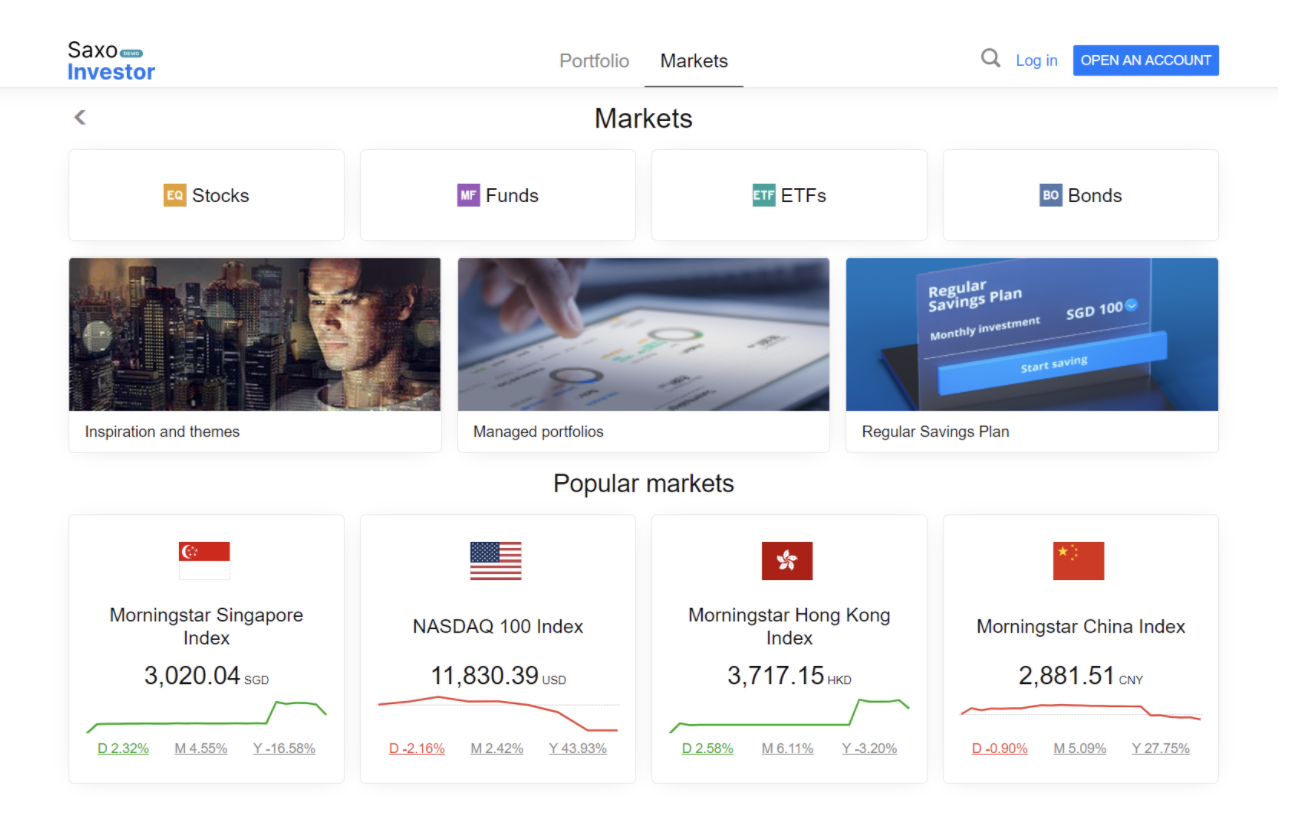

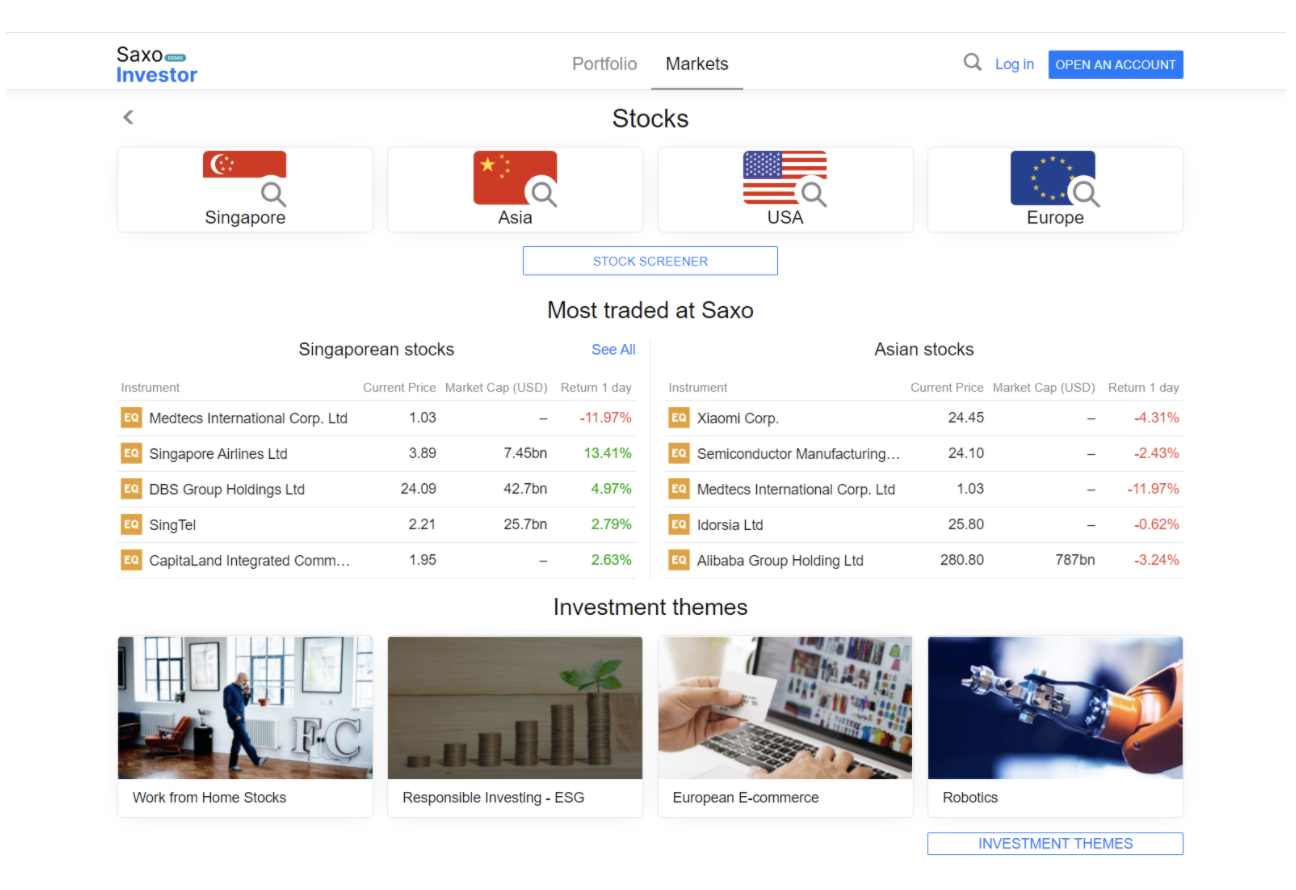

SaxoInvestor is on the other end of the spectrum and is designed for the typical retail investor – basically normal people like you and me.

It offers cash only products and has investment themes that provide an overview of trends in relevant return products such as electric vehicles and robotics to “inspire” novice investors.

Each topic has a curated list of relevant stocks, mutual funds, and ETFs.

Saxo also offers a regular savings plan that allows you to invest in managed ETF portfolios offered by wealth managers BlackRock and Lion Global.

It allows you to build long-term savings with an initial minimum investment of $ 2,000 and subsequent regular monthly contributions starting at $ 100. The service fee ranges from 0.25 percent to 0.75 percent per year.

You can use all three platforms for free to monitor your investments and place trades. You can also read about global news in different industries and get a better understanding of what products to buy next.

Saxo also seeks to target different levels of investor with video tutorials on the basics of trading, risk management and trading, regular podcasts on market insights and webinars.

How do I apply for a Saxo Markets account?

If you want to try Saxo, opening an account is free and pretty easy as SingPass holders can log in through MyInfo which will pull up your personal information.

The process is quick and painless. You can set up and get your account up and running in five minutes, simply transfer funds to your account via bank transfer (PayNow, FAST, iBanking or MEPs), credit or debit card, and then start trading.

Saxo offers a web version for desktop, as well as an app for Apple and Android mobile devices, and the interface is fairly simple so you don’t have to be a rocket scientist to find out.

The good thing is that once you have an account you will have access to all three of Saxo’s investment platforms.

Note that while there is no minimum funding requirement for SaxoInvestor, SaxoTraderGO and SaxoTraderPRO require a minimum deposit of $ 3,000.

Instructions for trading on Saxo Markets

Once you have opened your account, you can log in to access Saxo’s platforms and purchase products on your preferred platform.

How to get started with SaxoInvestor:

If you click on the Stocks page, you’ll get an overview of various global stocks.

Click US Stocks, then click Apple Inc. For more details on Apple pricing and performance. When you have decided to buy, click the blue TRADE button to open a trade ticket.

Simply enter the number of shares you want to buy and click BUY to confirm your purchase.

SaxoTraderGO (below) allows you to create a watchlist of products that you can keep an eye on, track, and then place orders.

They have fairly detailed video tutorials on how to place orders for various products on their support page.

Who should use Saxo Markets?

Saxo Markets’ SaxoTraderGO can be a great choice if you want to trade forex or stocks in forex as it provides access to those markets at a good price and on a platform that won’t make you want to pull your hair out.

Saxo is known for its lower commission fees compared to other online brokers.

Note, however, that you will have to pay custody fees on all non-SGX stocks, ETFs, and bonds.

[[nid:540698]]

If you are only trading on SGX, Saxo is offering a good price. However, if you are not comfortable having your stocks custody instead of being transferred to your CDP account, then you need to look elsewhere.

Remember that if you want to use the Saxo platform not only to buy and sell your stocks, but also to check stock prices and view charts, you should make sure that it works well and is easy for you to use, especially if you tend to trade frequently and on the go.

Beginners should consider SaxoInvestor as it provides access to a large basket of products and has a simpler user interface so you don’t drown in information overload.

If it’s your first time, you can also watch the how-to videos to help you find funds, monitor your investments, and move on to more complex products.

If you need help, Saxo has a detailed FAQ section in their support center or you can contact them via the live chat on the Saxo platform. If you have a VIP account, you will be assigned a dedicated account manager.

Alternative investment brokerage to Saxo Markets

TD Ameritrade – TD Ameritrade is one of the largest and most established discount brokers in the United States, regulated by the big guns at just $ 0.70 per transaction.

POEMS – POEMS from PhillipCapital is a trusted local investment platform that also offers access to SG and US stocks for pretty decent fees. A great option for local investors looking to get their feet wet.

Compare Singapore Investment Brokerages Online Before Committing.

This article was first published in MoneySmart.