Wealth development, wealth development, appreciation … we Singaporeans have all sorts of names for it, but the basic idea is the same: use your existing property as a stepping stone to a bigger or more luxurious home (or just one with more investment potential).

There are a few different considerations from common home buyers when looking for asset development – and these are some of the following to look out for:

1. Transaction history with sufficient volume

If you want to choose between “stepping stone” properties, you should compare profits for the property in question or for properties nearby (if the development is new).

However, an often overlooked problem is transaction volume. For example, consider the transaction volume for Botanika in District 10:

For many years after the initial sales, there were few and isolated transactions (as of January 2010, all transactions are single units).

This makes the “median price” of $ 1,881 somewhat uncertain as it is based on a single unit; and you can see that the price movement is quite volatile.

Conversely, D’Leedon – which is within a kilometer of Botany – has a large number of units and good transaction volume:

This gives you a more reliable picture of price movement (currently at $ 1,421 to $ 1,937 psf, averaging $ 1,682 psf) over the years.

To be clear, we’re not saying D’leedon is a better condo, we’re simply saying it better reflects price moves and gains. This is an important factor if you have the intention of definitely reselling in a couple of years and want to make sure resale profits can fill the void on your next home.

It also means that buyers with a clear expansion plan tend to prefer larger developments in terms of quantity. This is because most boutique projects with fewer than 100 units tend to have fewer transactions and more volatile price movements.

One benefit of using HDB apartments for wealth development is indeed the volume of transactions – prices tend to be well supported and fairly predictable, unlike some niche private counterparts.

2. Sufficient residual rent for resale profits

Most upgraders don’t expect to stay long at a “stepping stone” hotel. A typical example would be expecting to stay in a resale apartment for only five years (the length of the MOP) or only five to ten years in a condominium.

However, banks often reduce the financing of real estate with a term of 60 years or less. Loans are not available for properties with a rental period of 30 years or less. Therefore, older leasehold properties – around the age of 30 to 40 years – can be impaired even more by renting them out.

Another overlooked aspect is the potential buyers: If the lease only lasts a few decades, the property is often bought by retirees, those who are not interested in handing over their children, or by investors who pay attention to the pure rental return.

These buyers don’t make up the bulk of the market, and many of them are pretty conservative. Therefore, older leasehold properties can already be more difficult to sell, let alone with a good profit.

This doesn’t necessarily mean that you need to buy a condominium or a new startup unit. The bonuses associated with it could work against you too. There’s a delicate balance between finding the right price point, room for appreciation, and avoiding serious rent forfeit.

Let us advise you, because this is not the easiest balancing act.

3. The property shouldn’t be a trend hunter, which can lead to niche / inefficient floor plans

We have described many of these undesirable properties in a previous article.

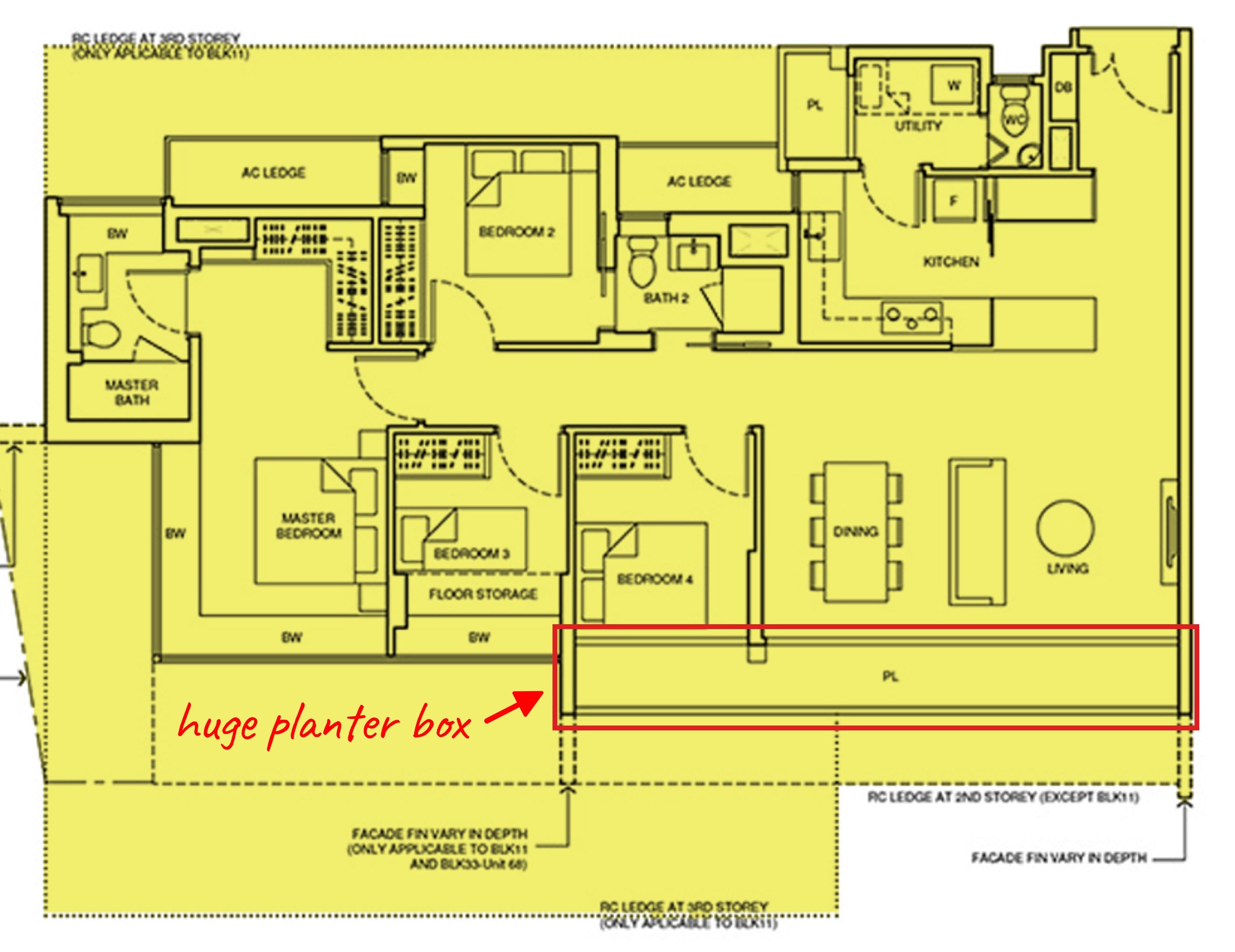

Existing trends can make a certain unit “hot”. Some of the things we’ve seen over the years are high floor-to-ceiling ratios, an craze for private enclosed spaces (PES) in the form of patios, and elaborate “green facade” plant boxes.

These market hogs sometimes (but not always) lead to markups or inefficiencies. For example, white space for Strata titles, which is usually a useless additional cost; it is the price of the empty space between the floor and the ceiling.

Depending on the trend, certain ones may not last very long and can change within a year. As an upgrader, you don’t want to find out – in five years – that a “cool” feature like an attic ceiling actually makes it difficult to sell your device.

It is best to ignore the trends and focus on the basics like location, number of units, etc.

This can lead to the fact that you buy a “boring” device, which you as a homeowner are not exactly enthusiastic about. But that’s a good thing, because it’s not your dream home: it’s just a stopover on the way there.

4. 500 to 600 units (medium size) is a nice number to aim for

Boutique developments usually have low transaction figures and volatile prices (see point 1). Conversely, very large developments – such as 1,000+ units of mega developments – bring with them a lot of competition.

When the time to sell and upgrade, the last thing you want to see is 100+ listings in the same condo, all selling similar units to yours. This sometimes degenerates into a price war from which none of the sellers benefit.

In general, midsize developments combine lower maintenance fees and a reasonable price without the overcrowding.

5. For HDB properties, the MOP must match your timeframe

For example, if your goal is to upgrade in five years, a BTO flat rate is not suitable for this purpose. You have to wait four to five years for the apartment to be completed and then another five years for the MOP.

Unless you have an apartment with the (unusual) ability to increase in value, as well as private property, the delay could lead to difficulties later in bridging the price difference.

This is particularly a problem with the new Prime Location Housing (PLH) model. Nobody really knows whether the upgrading of PLH apartments – after the severe restrictions – can compensate for the extra long MOP time. It will take you 14 to 15 years to upgrade when you factor in the build time.

For this reason, many upgraders are advised to opt for smaller, cheaper resale homes. and difficult to save during the MOP. However, the circumstances are different for everyone.

For example, if you know you won’t be able to upgrade in five years, it can’t hurt to get a BTO flat and wait longer. The lower price of BTO apartments may even work in your favor in the end.

The key is to have a schedule or plan for your upgrade so that you can buy something that suits you.

6. Check for potential upgrades in the neighborhood within the correct timeframe

We discussed how to use the URA master plan to identify potential upgrades.

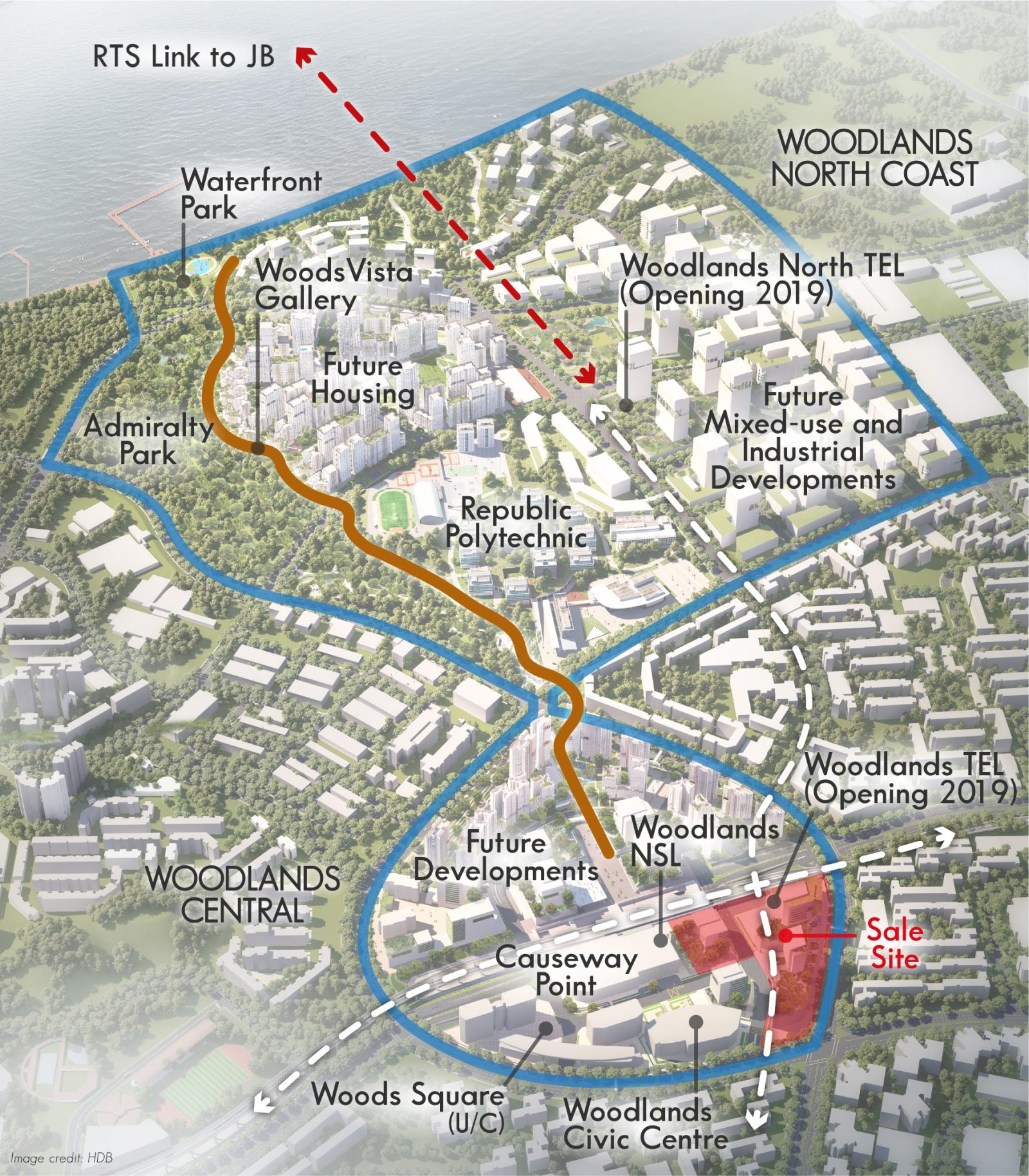

However, it is also important to know the time frame. In 2021, it would make sense for an upgrader to consider the Woodlands North Corridor.

This is because we learned – back in 2017 – that the first developments would appear in five to ten years (from 2022). With a five year period to upgrade, it is plausible that buyers will sell as soon as the upgrades take effect.

The Greater Southern Waterfront (GSW), on the other hand, will likely set in well after 2040. So even if you were to buy a condo that could benefit from it, we wouldn’t expect that to affect profits if you were only selling for five to 10 years.

7. A new product or two nearby may be good

New products to market are always more expensive than their existing counterparts. This creates a “call waiting” effect, as the average price psf in the neighborhood will rise. In areas where new condos are rarely found, prices can end up stagnating quite a bit.

As such, it can sometimes be helpful to have an upcoming start or two within a kilometer.

However, there is a limit to this. As we saw in Holland V, too many new product launches nearby create competition and saturate the area.

The numbers are also misleading: if there are many new product launches in a short period of time, the price for the neighborhood can skyrocket. However, this is more due to the rising prices due to new product launches than to the reality on site.

The increasing number of units can also lead to competition and later dampen potential profits if demand in the region does not increase.

While new product launches can help drive prices up, sometimes you want to avoid properties where potential new product launches are too close. This only creates a newer, more attractive looking alternative for buyers in the future. This can usually be seen on the URA master plan as vacant residential properties near the project.

This article was first published in Stackedhomes.